'If only I had a second chance'

No matter our age, most of us would probably look back on some aspects of our lives and say to ourselves: “If only I could do that again; if only I had a second chance”.

This, of course, tends to occur quite frequently in regards to our investing and saving.

Often, we regret not giving enough attention in the past to our personal financial planning, not beginning to invest regularly from early in our working lives and not adequately diversifying our portfolios.

And most of us probably have made investments that we wouldn’t have touched in hindsight.

Just think about what you may have done differently with your investing and your financial planning if you had a second chance. This may help guide what you do in future.

A Vanguard study published earlier this year included a survey of more than 700 Australians aged 55-75 who had retired within the past 10 years, asking what they would have done differently with preparing for their retirement.

Perhaps unsurprisingly, many of these recent retirees strongly believe that they should have saved more (45 per cent of survey respondents), begun planning earlier for retirement (36 per cent) and spent more time on retirement planning (28 per cent).

In line with this what-would-I-do differently theme, online investment newsletter Cuffelinks published an excellent looking-back article a few months ago for its 200th issue.

Cuffelinks asked 37 well-known investment and economic specialists: “What investment insights would you give your 20-year-old self if you could go back in time?”

Their responses included: keep a budget, make the most of compounding returns, start saving and investing early, understand the relationship between risk and return (the higher the potential return, the higher the potential risk), hold a diversified portfolio, set an appropriate strategic asset allocation and understand that investment markets move in cycles.

And other responses included: avoid emotional-investment decisions, avoid chasing the investment herd, block out dist

racting market “noise” and don’t pay excessive fund management fees. Another twist on looking back for investors comes from US personal finance author Paul Brown. It’s been 30 years since Brown, who is over 60, wrote his first book on saving for retirement.

As he enters the popular age group for retirement, Brown asked himself in a New York Times article if his advice may have changed over the past three decades given his real-world experience.

“No, I wouldn’t change any of the advice,” Brown writes. “I told people to start saving aggressively while they’re still young and to diversify their holdings. It was good counsel then and it is good counsel today.

“I also remain a steadfast believer in index funds and in keeping investment costs as low as possible,” he adds. “That’s how I have invested just about all of my retirement savings.”

Yet based on his experiences, Brown says he would have added “not only more empathy but more real-world advice”.

Two of his additional suggestions are to extend your working life, if possible, past conventional retirement ages and save more than you think you need because life doesn’t always go according to plan.

It can be a valuable exercise to think about what we would have done differently as investors if given a second chance.

When looking back, however, watch out for the trap of becoming overly focussed on a past investment loss; it could impede your willingness to take appropriate risks in the future, as behavioural economists warn us.

Please contact us on 9836 8399 if you seek further assitance .

Source : Vanguard 10 November 2017

Written by Robin Bowerman, Head of Market Strategy and Communications at Vanguard.

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2017 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for any action or any service provided by the author.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

The critical difference between desired and required returns

We probably all remember during those long difficult car trips as children repeatedly saying such irritating things to our parents as: “When do we get there?”. Perhaps adding to reinforce the point, “I knew we would never get there”.

And then pleading whenever a fast-food joint appears on the horizon: “I NEED an ice cream”.

Fast forward to today and think how we broadly face similar fundamental, yet much more complex, issues regarding our retirement savings.

Astute investors set their long-term goals – the parallel being the destination of those seemingly-endless childhood road trips – and then work out how to get there.

And a critical challenge for investors is to make the often-overlooked distinction between the required returns from their portfolios to reach their intended investment destinations against their desired returns. (This equates to separating between NEEDING that ice cream as a child or merely just wanting one.)

The separation of desired and required returns, ideally at the beginning of the financial planning process, is truly an investment fundamental. Distinguishing between desired and required returns should help guide investors to selecting appropriate asset allocations for their portfolios given their personal circumstances including their unique goals and tolerance to risk.

In other words, the process of separating between returns in this way should assist investors narrow the range of asset allocation choices suitable for them.

An updated Vanguard research paper* – Required or desired returns? That is the question – suggests that many investors will find that the return required to achieve their long-term goals is “meaningfully less” than their desired return.

And, of course, higher returns are associated with higher risks.

The research paper ends with a twist: “Ironically, for many investors the means to a better investment outcome and greater wealth may be a more balanced portfolio with lower expected returns, rather than one focused on higher returns.”

Please contact us on 9836 8399 if you seek further discussion .

*Required or desired returns? That is the question by Vanguard investment analysts Donald Bennyhoff and Colleen Jaconetti.

Written by Robin Bowerman, Head of Market Strategy and Communications at Vanguard.

Source : Vanguard 20 November 2017

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2017 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for any action or any service provided by the author.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

How to explain our irrational behaviours

Nobel prize-winning economists do not usually have a lot to say to everyday investors.

This year is different.

Professor Richard Thaler won the Nobel memorial prize for economics for his work in behavioural economics. In short, he won for the understanding he has brought to the way ‘real’ people think and react when making financial decisions.

His work has largely been about challenging classical economic theory about how the world works – in particular he has challenged, and at times ridiculed, the notion that we all act like rational economists all of the time when making big financial decisions.

Where his work broke new ground was in establishing ways of measuring and indeed predicting our supposed “irrationality” in in order to help and inform public policy settings.

Part of the brilliance of Thaler’s work was in capturing the absurdity of pure economic rationalism and expressing it in a simple way that non-rational economic types could relate to.

Like the real-world challenge that comes with deciding what gift to buy a significant other on a birthday or anniversary.

For the rational “econs” as Thaler terms them the answer is elementary – cash.

A gift of cash has the ultimate utility – the recipient can buy whatever they want when they want.

Job done.

Thaler in his book Misbehaving: The Making of Behavioral Economics does not recommend you take this approach with your partner – even if you are married to an economist.

The true value of Thaler – and other behavioral economists like Daniel Kahneman, who broke new ground and also won the Nobel prize in 2002 – is helping us understand our supposedly irrational behavior and put it to work to deliver better outcomes.

For example, in retirement income systems like the US and UK the decision to save for retirement is voluntary so naturally many people don’t. Thaler’s work helped support the idea of auto-enrolment where employees are automatically enrolled in the retirement savings scheme unless they decide to opt out. Most people don’t. With auto-enrolment the human failing of inertia that means most people do not opt in now works in their favor. Auto-escalation uses the same process and means your level of savings rises automatically each year until you say stop or it reaches some defined maximum level.

To getter a better understanding of the practical application of behavioral economics Thaler’s book Nudge – co-written with Harvard Profession Cass Sunstein- provides a terrific insight to our very human ways of responding to situations and the ways we make decisions.

For example why people will refuse to pay more for an umbrella during a storm or why when the price of petrol falls more people buy the more expensive premium fuel for their car.

On many levels when you read Thaler’s work it seems so damn self-evident. His gift to the world of investing is acknowledging our human emotions and foibles which hopefully will help up us be more aware of how emotion can so clearly bypass the strongest rational theory.

Source: Vanguard 18 October 2017

Written by Robin Bowerman, Head of Market Strategy and Communications at Vanguard.

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2017 Vanguard Investments Australia Ltd. All rights reserved.

Important: Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for their action or any service they provide. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

Think ahead about smart retiree spending and investing

A common personal finance trap is to concentrate on saving and investing to finance our eventual retirement without thinking enough in advance about how to invest and spend that money in retirement.

Given that we have so much going on in our lives long before retirement –such as our careers, dependent children, home mortgages and trying to save – this focus on accumulation is understandable. But it’s only part of the equation.

It makes sense to begin developing smart retiree spending and investing strategies long before retiring. This should help you think about what are your personal and investment goals as a retiree and how much you need to pay for those goals.

It’s working out the destination and deciding how to get there.

Aiming to save a certain total amount before retirement is obviously valuable, but you should also think about what the capital will eventually provide in terms of retirement income and, critically, how to invest that money. In turn, this may prompt you to step-up your retirement savings.

At the beginning of their final 10 years or so in the workforce, many forward-thinking investors would begin to think more about developing thorough retirement spending and investing strategies. Importantly, they may still have the ability to boost their savings if necessary.

In turn, this count-down stage to retirement is one of the times when a skilled financial planner can be most valuable.

The combination of historically-low yields, expected muted investment returns and growing life expectancies are high among the incentives for retirees to become smarter with their drawing down, investing and spending of their retirement savings.

“The need for retirees to implement informed portfolio spending strategies is more critical, and yet more complex than ever,” comments a Vanguard research paper, From assets to income: A goals-based approach to retirement spending*.

“For retirees, the stakes are high,” the paper adds, “and the impact of subpar decisions can be severe.”

As the paper’s authors say, there is no one-size-fits-all strategy for developing and implementing a spending strategy because every retiree’s circumstances are different to varying degrees. However, a spending strategy can reduce the “anxiety and stress” regarding the ability of retirees to meet their retirement-income goals – no matter their circumstances.

Many Australian retirees will have, of course, a combination of super and non-super savings with various tax consequence, further underlining the need for good professional advice.

The goals-based spending strategy discussed in this Vanguard paper has three primary components:

Develop a prudent spending rule tailored to a retiree’s unique goals

This involves dealing with your competing goals – including differentiating between needs and wants – and planning to make your savings last given uncertainty about life expectancy and movements in investment markets, which are beyond an investor’s control.

A critical issue here is how much can retirees “safety” withdraw from their portfolios each year to finance their current spending and to generate future income for the rest of their lives, no matter how long.

Vanguard’s paper suggests a “dynamic-spending rule”. This provides for retirees to set a maximum and a minimum for their annual spending limits – in other words, a floor and a ceiling – reflecting the performance of the markets and a retiree’s unique goals.

The next Smart Investing looks closely at the dynamic spending rule with its ceiling and floor on annual spending based on percentages of a portfolio’s value.

Retirees can aim to spend a higher percentage of their portfolio’s value when markets have done well and reduce spending to a lower percentage – within these set and acceptable limits – when markets haven’t done as well.

Construct a broadly-diversified retirement portfolio

In line with Vanguard’s principles for investing success, this involves setting clear and appropriate investment goals, developing an appropriate and diversified asset allocation, minimising investment costs and maintaining a disciplined, long-term and non-emotional approach to investing.

As the paper explains, taking a total return approach to investing and spending can make much sense for retirees. This involves focuses on both the income and capital growth generated by a portfolio rather than merely on income. Total-return approach should help a retiree maintain a portfolio’s diversification, allow more control over the size and timing of portfolio withdrawals and increase a portfolio’s longevity.

Develop a tax-efficient investment and withdrawal approach

Retirees can potentially increase their spending amounts and the longevity of their portfolios by making their investing and withdrawing from super and non-super portfolios as tax efficient as possible. (A superannuation fund is not taxed on assets backing a pension, excluding a transition-to-retirement pension. Nor is the pension income taxable in a retiree’s hands.) Tax is among the areas where professional advice can be vital.

Please contact us on |PHONE| for further assistance .

* From assets to income: A goals-based approach to retirement spending, September 2016, by Colleen Jaconetti, Michael DiJoseph, Zoe Odenwalder and Francis Kinniry.

Source: Vanguard 18 October 2017

Written by Robin Bowerman, Head of Market Strategy and Communications at Vanguard.

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2017 Vanguard Investments Australia Ltd. All rights reserved.

Important: Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for their action or any service they provide. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

Technology: An adversary in the fight for 2% inflation

It’s been a generation since inflation last ravaged Australia, with costs for ordinary consumer goods rising on a seemingly daily basis. Indeed, in the wake of the global financial crisis, inflation in many countries has been lower than policymakers would like.

Low inflation, it turns out, can be a problem too.

Over time, declining or stagnant prices can strangle economic growth, depress workers’ earnings and erode standards of living. That’s why central banks here and in the US, Japan and Europe have tried to nudge inflation upwards to 2% or so – a rate thought sufficient to keep prices and wages rising without causing consumers too much pain.

The causes of low inflation range from globalisation, sluggish economic growth around the world (including a slowdown in China), and “transitory” factors” such as cheaper mobile phone plans.

But they’re not the whole story, according to Joe Davis, Vanguard’s global chief economist.

“Technology is an important, and often overlooked, challenge that central banks face in sustainably meeting their inflation targets,” said Mr Davis. “Our calculations reveal that technology’s role in the economy is growing exponentially. And, of course, technology’s reach extends well beyond Silicon Valley.”

Moore’s Law: A high-tech drag on inflation

You may not have heard of Moore’s Law, but you’ve been affected by it.

Coined by Gordon Moore, founder of the US tech giant Intel, Moore’s Law began as a way of explaining the swift improvement in computers’ processing abilities. Lately it’s become shorthand for the spread of ever more powerful – and cheaper – technologies. We see it in consumer electronics: the mobile phone that’s twice as powerful and half as expensive as the one you replace, or the new TV that is flatter, sharper, and cheaper than last year’s model. These direct effects drag down measures of inflation for those products.

“Moore’s Law is about more than mobiles, TVs and Amazon Prime,” Mr Davis said. “Its knock-on effects restrain the need for higher prices in every corner of the economy, not just in high-tech products. In an increasingly digitised world, the cost of producing many goods and services keeps inching lower and lower.”

By analysing detailed industry data from the US Bureau of Labour Statistics and Bureau of Economic Analysis, Vanguard found that improvements in technology reduced annualised inflation in the US by half a percentage point. Without Moore’s Law, in other words, that elusive 2% inflation target would have been achieved years ago. Interest rates would be higher.

“The impact is most pronounced in technology-intensive industries,” Mr Davis said. “Moore’s Law helps explain how investment managers like Vanguard can serve clients at ever-lower cost. It’s key to the lower-cost electric cars rolling off assembly lines in Silicon Valley and Detroit. And it helps explain the slowing rates of inflation in fields like education and retailing.”

The inflation debate

So far, there’s little sign that policymakers at the US Federal Reserve are factoring Moore’s Law into their discussions about why their 2% inflation target keeps slipping into the future.

“Moore’s Law deserves a seat at the table,” Mr Davis said. “It provides a more complete and accurate picture of the forces that shape monetary policy and inflation. And it bolsters Vanguard’s long-held view that lower unemployment is less likely to set off the kind of inflation rises that it did before Moore’s Law was in full effect.

“We live in a digital world that makes 2% inflation harder to achieve,” he added. “To ensure a victory in their fight, policymakers need to better appreciate this new technological challenger in the ring.”

Source : Vanguard October 2017

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2017 Vanguard Investments Australia Ltd. All rights reserved.

Important: Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for their action or any service they provide. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

The art of downsizing

The kids have finally left home and now you’re rattling around in a house way bigger than you need. If it’s time to think about downsizing, there’s more to it than simply selling one house and buying another. Here are a few things to consider.

Tax-free gain

Selling a large house and buying a townhouse or unit, perhaps in a more affordable suburb, can free up a significant sum of money which you could use to help fund your retirement or take that dream international holiday. But before you get too excited by your potential windfall, remember to take into account expenses such as agent’s fees, removalist costs and stamp duty on the new property. This will give you a better idea of how much additional cash you are likely to be left with.

Generally, any capital gains on the sale of the family home are exempt from capital gains tax (CGT). However, if the home has been used for income-producing activity, such as running a business or letting out a room, then a portion of the gain may be subject to CGT.

On the upside, downsizing may reduce your living costs. New homes are usually more energy efficient, and cost less to heat and cool than older housing stock.

Centrelink considerations

The family home is exempt from Centrelink’s age pension asset test. If qualifying for a full or part age pension is important to you, you may not want to free up too much cash when downsizing.

Indeed, some retirees actually dip into their savings to buy a higher value home. Their aim is to reduce their assessable assets and maximise their pension entitlement. This isn’t always a good idea as it increases the risk of being caught in the ‘asset rich, cash poor’ trap.

Super boost

As an incentive to downsize, the federal government has proposed that from July 2018 Australians over the age of 65 will be permitted to make a contribution to super of up to $300,000 each ($600,000 for a couple) from the proceeds of selling their home. The amount will be treated as a non-concessional (after-tax) contribution, and exempt from the usual restrictions. But this proposal has yet to be legislated.

For most people under 65, super may also be a desirable destination for most of the money freed up by downsizing. Make sure that any contributions fall within the relevant limits.

Emotional cost

While the financial benefits of downsizing can be considerable, moving house is amongst life’s most stressful events. This is particularly the case when you are giving up a home full of family memories, and parting with many prized possessions to fit into a smaller space. Just being aware that you may face an emotional reaction is a start, but be open to seeking professional support if moving does bring on a bout of the blues.

Seek financial advice

Downsizing has both financial and lifestyle dimensions, and you’ll want to make the most of any profits you realise. Talk to your financial adviser before you get the real estate agent in. He or she will work with you to craft a short-term strategy to help ensure your downsizing experience supports you in achieving your long-term goals.

To further assistance please contact us on 9836 8399

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee takes any responsibility for their action or any service they provide

How to develop a "dynamic" approach to retiree spending

As Smart Investing recently discussed, the combination of historically-low yields, expected muted investment returns and growing life expectancies are making it particularly challenging for retirees to calculate how much to draw down from their retirement savings.

A critical issue here is how much retirees can withdraw from their portfolios each year to finance their current spending and to generate future income for the rest of their lives, no matter how long. It’s challenging.

Two traditional approaches are to draw down a set percentage each year of a portfolio’s value or to set a dollar amount to withdraw in the first year of retirement and then to increase that amount annually by the level of inflation.

One of the difficulties with the set percentage-of-portfolio withdrawal strategy is that the dollar amount withdrawn and spent each year may much depend on how the markets have performed. This makes budgeting even tougher.

While the dollar-plus-inflation strategy may provide the comfort of an inflation-adjusted income, retirees face the risk of spending more than they can afford when markets have underperformed, increasing the risk of depleting their savings. And after markets have performed strongly, the dollar-plus-inflation strategy may lead to retirees spending less than they can afford.

Several Vanguard research papers* discuss a “dynamic-spending rule” as another approach to retirement drawdowns and spending. This provides for retirees to set a maximum and a minimum percentage withdrawal limits for their annual spending limits – in other words, a floor and a ceiling – based on the performance of the markets and a retiree’s unique goals.

As the authors of the papers explain: “To implement the dynamic spending strategy, a retiree would first select a spending rate or the percentage of the portfolio that will be withdrawn in the first year, as well as a ceiling and a floor.

“The ceiling is the maximum amount,” the authors explain, “that you are willing to allow real (inflation-adjusted) spending in any given year, while the floor is the maximum amount you can tolerate for real spending to decrease in a given year.”

It should be emphasised that the actual percentages for a floor and ceiling depends much depends on retirees’ circumstances, including whether they are conservative, balanced or more aggressive investors. For instance, a floor might be 2.5 per cent, while a ceiling could be 5 per cent of the portfolio’s value in the previous year.

Retirees can spend a higher percentage of their portfolio’s value when markets have done well in the previous year and reduce spending to a lower percentage – within these acceptable limits – when markets haven’t done as well.

Of course, many retirees receive a superannuation pension with a set aged-based minimum withdrawal rate. By taking a dynamic approach, such members could calculate how much to reinvest, if any, each year.

When a portfolio returns are above a retiree’s drawdown ceiling, an opportunity should arise to build up a portfolio in particularly good years. This has a smoothing effect for the years when returns are down.

For further asistance please contact us on 9836 8399

* A rule for all seasons: Vanguard’s dynamic approach to retirement spending, April 2017, by Michael DiJoseph, Colleen Jaconetti, Zoe Odenwalder and Francis Kinniry.

* From assets to income: A goals-based approach to retirement spending, September 2016, by Colleen Jaconetti, Michael DiJoseph, Zoe Odenwalder and Francis Kinniry.

Source : Vanguard 18 October 2017

Written by Robin Bowerman, Head of Market Strategy and Communications at Vanguard.

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2017 Vanguard Investments Australia Ltd. All rights reserved.

Important: Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for their action or any service they provide. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

Has your business got this covered?

It’s not uncommon for business owners to take short, irregular holidays because they don’t have the support to keep their business running without them for a longer break.

Aside from taking time off for leisure, have you considered what would happen if you were forced to take six months off work due to a serious illness or injury?

Would the business survive and how would the bills be paid? Or if you were to die, can you be sure that your business partners would give your family a fair deal?

For these reasons, it’s important for all business owners to put in place a properly prepared succession plan. It’s just like a Will for the business, but there is often a wider range of scenarios and considerations involved.

As with a personal Will, what should be included in a good business succession plan can vary from one situation to the next. Here are some key areas that should always be considered:

-

Business structure – in the event of death or retirement, the ownership and control of the business may need to be transferred to the owner’s family or to the surviving business partners. How easily this would occur will often depend on how the business operates, such as through a trust, or a company, or without a separate entity at all.

-

Succession agreements – if something happened to one of the business partners, would that partner’s spouse or children be capable of taking over the control of that share of the business? If the answer is no, then a succession agreement can assist the remaining business partners to carry on operating the business whilst allowing for adequate compensation for the former partner’s family.

-

Managing risk – just like personal insurance, business insurance can provide a variety of types of protection such as temporarily meeting the normal costs of running the business (business expenses cover) or paying for a short-term replacement manager (eg. trauma or disability cover). A life insurance policy linked to the succession agreement that provides the deceased partner’s family with suitable compensation for the transfer of business ownership to the surviving partners can also be a good idea.

-

Powers of Attorney – many small businesses can’t do much without the authority of the key decision-maker, so a Power of Attorney is integral to the succession planning process. It helps the business to physically operate if the owner is incapacitated through illness or injury.

There is a range of professionals who may need to be involved in setting up a succession plan, including your financial adviser, lawyer and accountant. Even if you already have a plan in place, make sure you regularly review the agreements and your insurance policies to keep them up to date and reflecting the current value of the business.

Like a Will, don’t leave this to when it’s too late.

For further assistance please contact us on |PHONE|

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee takes any responsibility for their action or any service they provide

Does money bring happiness?

The short answer is ‘yes’, but only up to a point. People in richer countries are, collectively, happier than people in poor countries. Within countries, people with higher incomes are generally happier than people on low incomes. Surprisingly, once basic living needs are met, the amount of happiness gained from each additional dollar of income rapidly declines.

What is ‘happiness’?

What is it about money that contributes to happiness? And what does happiness even mean? Perhaps what people are really expressing is contentment or satisfaction with their lives.

Rather than putting us into a perpetual state of bliss, money is more likely to contribute to a sense of security, better health, less stress and, perhaps above all, choice.

It’s interesting to see what choices boost happiness. For example, in something of a paradox, giving money away makes people feel happier than spending it on themselves.

And experiences such as travel or skydiving, or even just going to a movie, provide more enduring satisfaction than material purchases. Good memories, it seems, provide better value than physical possessions.

Happiness planning or financial planning?

What does this have to do with financial planning?

Well, for many people, their financial plan is all about milestones: buying a house, meeting school fees and funding retirement. Important as these things may be, what’s missing is the journey – and no, that doesn’t mean the insurance premiums, super contributions and mortgage repayments. It means Santorini sunsets, sand between the toes and, perhaps more important than anything, time spent with family and friends.

On that basis, instead of financial planning maybe we should call it ‘happiness planning’?

Of course your plan will have a financial component, but it will be focused on the journey of life, rather than financial destinations; on achieving a balance and knowing what’s ‘enough’. It will be more about experiences, bucket lists and relationships than annuities, tax refunds and superannuation.

Putting it into perspective

Yes, money is important in providing choices and experiences, and that’s probably a major reason why richer people report higher levels of happiness.

And yes, your financial planner is going to mainly focus on super and investments and insurance as the means of opening up more options for you. Just don’t let that become the be all and end all.

More people are happily rejecting the idea of a conventional retirement. Technology is helping to blur the lines between work and play, and Millennials are opting to pursue experiences now with the expectation that they will work in some form well beyond today’s typical retirement age.

So ask yourself: what makes you happy? What sort of choices do you want to be able to make? Then share the answers with your financial planner, and ask for a plan that will not only meet your long-term needs but also allow you to indulge your shorter-term whims and desires.

To discuss further please contact us on |PHONE| .

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee takes any responsibility for their action or any service they provide

Wrapping up your super

Self-Managed Super Funds (SMSFs) have their attractions, but many find the administration effort and associated costs prohibitive. If you would like to take greater control of how your superannuation is managed but don’t want an SMSF structure, perhaps a Super Wrap is more your style.

A Self-Managed Super Fund is a portfolio of individual assets, grouped together to create an investment strategy. Each asset attracts its own fees and has its own tax arrangements. The overall SMSF is regulated by a set of rules known as the trust deed and is overseen by a trustee.

Conversely, a Super Wrap is a superannuation strategy that enables you to bundle a portfolio of ASX listed shares, managed funds, cash and insurance into one complying account.

They differ from SMSFs in a number of ways – the most noticeable being that there’s no requirement for either trust deed or trustee and the associated costs are much lower.

As an investment alternative, they often have access to wholesale and institutional funds – assets not ordinarily accessible to individual investors due to their high minimum investment amount, sometimes as high as $200,000.

How does a Super Wrap work?

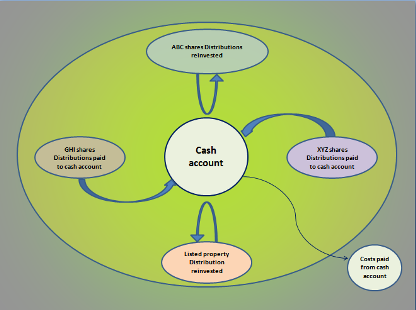

A Super Wrap enables you to ‘wrap’ a number of investments around a central cash account, all under the one ‘umbrella’ or wrap account. Investment distributions or income is either reinvested into the fund, or allocated to the cash account.

Fees and charges are deducted from the cash account instead of individual investments which, depending on share price movements, can disadvantage the asset and impede its earning potential.

What are the benefits?

Consolidated into one structure, Super Wraps benefit investors by:

-

requiring only one application form for set-up;

-

issuing one statement for the entire portfolio;

-

generally charging no exit or entry fees for switching between investments;

-

applying fees at the wrap level instead of each separate investment.

What does this mean?

Less red tape means your financial adviser can easily help you construct the most appropriate Super Wrap portfolio for your needs.

They offer more control over your retirement portfolio and freedom to make your own investment choices. Ongoing compliance, administration and trustee responsibilities are handled by the fund manager providing the wrap account. This translates into no headaches for you!

Reviewing your superannuation portfolio is less complicated and time-consuming than for a SMSF as asset allocations can be re-balanced in a single investment instruction.

Overall, a Super Wrap can provide a cost-effective and easily managed superannuation solution, but they’re not for everyone. As with any investment strategy, it’s always wise to seek professional guidance before making a decision.

For further assistance please contact us on |PHONE|

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee takes any responsibility for their action or any service they provide