Wrapping up your super

Self-Managed Super Funds (SMSFs) have their attractions, but many find the administration effort and associated costs prohibitive. If you would like to take greater control of how your superannuation is managed but don’t want an SMSF structure, perhaps a Super Wrap is more your style.

A Self-Managed Super Fund is a portfolio of individual assets, grouped together to create an investment strategy. Each asset attracts its own fees and has its own tax arrangements. The overall SMSF is regulated by a set of rules known as the trust deed and is overseen by a trustee.

Conversely, a Super Wrap is a superannuation strategy that enables you to bundle a portfolio of ASX listed shares, managed funds, cash and insurance into one complying account.

They differ from SMSFs in a number of ways – the most noticeable being that there’s no requirement for either trust deed or trustee and the associated costs are much lower.

As an investment alternative, they often have access to wholesale and institutional funds – assets not ordinarily accessible to individual investors due to their high minimum investment amount, sometimes as high as $200,000.

How does a Super Wrap work?

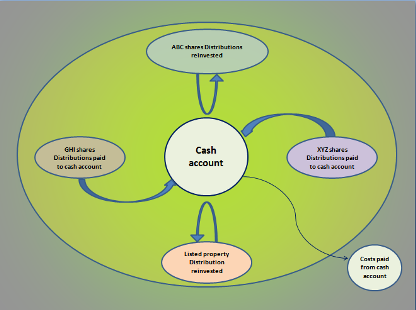

A Super Wrap enables you to ‘wrap’ a number of investments around a central cash account, all under the one ‘umbrella’ or wrap account. Investment distributions or income is either reinvested into the fund, or allocated to the cash account.

Fees and charges are deducted from the cash account instead of individual investments which, depending on share price movements, can disadvantage the asset and impede its earning potential.

What are the benefits?

Consolidated into one structure, Super Wraps benefit investors by:

-

requiring only one application form for set-up;

-

issuing one statement for the entire portfolio;

-

generally charging no exit or entry fees for switching between investments;

-

applying fees at the wrap level instead of each separate investment.

What does this mean?

Less red tape means your financial adviser can easily help you construct the most appropriate Super Wrap portfolio for your needs.

They offer more control over your retirement portfolio and freedom to make your own investment choices. Ongoing compliance, administration and trustee responsibilities are handled by the fund manager providing the wrap account. This translates into no headaches for you!

Reviewing your superannuation portfolio is less complicated and time-consuming than for a SMSF as asset allocations can be re-balanced in a single investment instruction.

Overall, a Super Wrap can provide a cost-effective and easily managed superannuation solution, but they’re not for everyone. As with any investment strategy, it’s always wise to seek professional guidance before making a decision.

For further assistance please contact us on |PHONE|

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee takes any responsibility for their action or any service they provide

Home-bias investing: A global phenomenon

Much attention is given to the powerful bias that many Australian investors hold for Australian investments, particularly our shares.

This home bias is, of course, not uniquely Australian. It is widely shared with investors in other developed countries including the US, UK, Canada and Japan.

American investors tend to favour American shares while Japanese investors often favour Japanese shares and so forth. Home-bias investing is truly a global phenomenon.

However, Australian investors’ strong tilt to local shares is particularly marked given that our local market accounts for such a small percentage of the global market.

Under-diversification has been described as one of the most-prevalent bad habits of investors; a critical concern because of the dominant influence that appropriate diversification has on long-term returns. And home-bias investing ranks among the biggest forms of under-diversification.

Recent Vanguard research* on home-bias investing found that:

- Australia: Australian shares accounted for just 2.4 per cent of the global share market in December 2014 yet Australians collectively held 66.5 per cent of their portfolios in Australian shares.

- Canada: Canadian shares made up 3.4 per of the global share market yet Canadians collectively held 59 per cent of their portfolios in Canadian shares.

- Japan: Japanese shares accounted for 7.2 per cent of the global share market yet Japanese investors collectively held 55.2 per cent of their share portfolios in Japanese shares.

- UK: While UK shares made up 7.2 per cent of the global share market, its investors collectively held 26.3 per cent of their portfolios in UK shares.

- US: While US shares accounted for 50.9 per cent of the global share market, American investors collectively held 79.1 per cent of their portfolios in US shares.

If investors choose to invest in the global market regardless of their home country, Australian investors would hold almost 98 per cent of their share portfolio not in Australian shares. Just think about it in regards to your own portfolio.

Investors with an excessive home bias are not adequately spreading their risks and opportunities. They are potentially paying a high price for the perceived comfort of restricting much of their investing to our home shores.

* The global case for strategic asset allocation and an examination of home bias, published by Vanguard, February 2017.

For further information or assistance please contact us on 03 9836 8399

Source : Vanguard 11 September 2017

Written by Robin Bowerman, Head of Market Strategy and Communications at Vanguard.

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2017 Vanguard Investments Australia Ltd. All rights reserved.

Important: Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for their action or any service they provide. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

How to make better investment decisions

We tend to take shortcuts when making numerous decisions in our lives, such as choosing a restaurant or when buying a new car. But don’t take shortcuts with investment decisions.

As a recent Vanguard research paper* observes, a common decision-making shortcut is to use a rating system based on the assumption that past performance will continue in the future.

It is hardly surprising that as this approach may seem to work for most everyday choices, investors are tempted to follow a similar decision-making process.

However, it is a fundamental trap to assume that past performance of an investment – whether good or bad – will continue.

The widespread reliance on past performance for making investment decisions is encouraged by the ready availability of past-performance data, often highlighted by commentators and fund managers.

And then there is the undue focus of many investors on short-term returns of individual investments and asset classes.

The flows of capital in and out of investments suggest that a high proportion of investment cash flow is driven by past performance data, including data entrenched in fund rating systems.

So, how can investors make better investment decisions?

The research paper’s authors, who are members of Vanguard’s Investment Strategy Group, put forward a four-part approach that moves away from a reliance on past performance to long-term planning.

Investors using this four-part approach to their decision making would:

-

Develop a financial plan to reach “clear and appropriate” goals.

-

Select a broadly-diversified portfolio across asset classes.

-

Minimise investment costs.

-

Periodically rebalancing their portfolio to keep it in line with its target or strategic asset allocation.

By taking this disciplined approach to making investment decisions, investors should become less vulnerable to being caught up with the prevailing investment moods that typically leads to buying when prices are high and selling when prices are low.

Financial planners can make a valuable contribution to the quality of investment decisions by encouraging investors to concentrate on long-term portfolio construction and goal setting – rather than on past performance.

Further reading: Vanguard’s principles for investing success (recently updated).

* Reframing investor choices: Right mindset, wrong market by Francis Kinniry, Colleen Jaconetti, Donald Bennyhoff and Michael DiJoseph.

Source : Vanguard 3 October 2017

Written by Robin Bowerman, Head of Market Strategy and Communications at Vanguard.

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2017 Vanguard Investments Australia Ltd. All rights reserved.

Important: Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for their action or any service they provide. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

The power of extra salary-sacrificed contributions

As the first quarter of 2017-18 draws to a close, it’s worth checking whether you are making the most of your ability to make regular salary-sacrificed super contributions.

If your salary-sacrificing contributions are lagging, think about stepping up your contributions for the remaining nine months of the financial year.

Your ability to step up your contributions – never overlooking the annual contributions cap – will much depend on your personal circumstances. There are, of course, two broad categories of super contributions – concessional (before-tax) contributions and non-concessional (after-tax) contributions, each with different annual contribution caps*.

If you are thinking of stepping-up your salary-sacrificed contributions, it is critical to keep in mind that the $25,000 annual concessional cap for 2017-18 applies to the total of the various types of concessional contributions, which include salary-sacrificed amounts.

Concessional contributions comprise compulsory (SG), salary-sacrificed and personally-deductible contributions (often made by the self-employed and investors).

Key changes affecting concessional contributions from 2017-18 include the lowering of the contributions cap to $25,000 for all members eligible to receive contributions. (The cap is down from a standard $30,000 or $35,000 if aged over 49).

And from 2017-18, the ability for individuals to claim tax deductions for personal contributions is broader and less rigid.

You may be eligible to claim deductions for your personal contributions if you are employed and earning a salary, self-employed, an investor or beneficiary of a trust.

The previous rule that you must not earn more than 10 per cent of your income from employment to claim deductions for personal contributions has been removed from 2017-18.

While these changes ease the rules on claiming deductions for super contributions, some members will need to keep a closer watch to ensure they don’t overshoot the concessional contributions cap.

Concessional contributions that exceed the cap are effectively taxed at an individual’s marginal tax rate (plus Medicare) and subject to an excess contributions charge for late tax.

It takes years to build up enough savings for a satisfactory standard of living in retirement. A smart strategy is to contribute as much as you can whenever you can – given your other commitments.

Are your salary-sacrificed contributions lagging?

* The annual contribution caps for 2017-18 are: $25,000 for concessional contributions; a standard $100,000 for non-concessional contributions (or $300,000 over three years).

Please contact us on 03 9836 8399 to discuss further.

Source : Vanguard 25 September 2017

Written by Robin Bowerman, Head of Market Strategy and Communications at Vanguard.

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2017 Vanguard Investments Australia Ltd. All rights reserved.

Important: Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for their action or any service they provide. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

Saving for a holiday

Whether it’s snorkelling on the Great Barrier Reef or going on safari in the Serengeti, your next holiday will cost money. It’s much better to save as much as you can before you leave, so you don’t rely entirely on your credit card. You don’t want to spend the next year paying off your trip debts.

Work out your holiday costs

The cost of your holiday depends on where you go and how you like to travel. Some costs to consider include:

- Airfares or transport costs

- Visa and passport charges

- Travel insurance

- Transport at your destination e.g. hire car

- Accommodation

- Food

- Entry fees to sights and activities

- Souvenirs

- Entertainment costs

- Extra money in case of emergencies

- Charges for using your phone for calls while you’re overseas

Smart tip

If you are exchanging money here or overseas shop around with a few different operators. Different fees and charges can have a big impact on how much cash you receive.

Accessing money

Think about how you are going to access money while overseas. If you carry lots of cash around, you risk losing it. You could get a travel prepaid card or you could talk to your bank about how you can access your money overseas without paying high fees.

For more information on travelling and safety precautions, see the Australian Government’s Smart traveller website.

Australians and travel insurance

Our Australians and travel insurance infographic explains why Australians travel, where they go, what is covered and isn’t covered by travel insurance and how to get the best policy for you.

Save as much as you can

Budgeting

Cut back on spending before you go and you’ll have more money to spend on your trip.

See where your money goes and find ways to spend less on non-essential items.

For example, Paul is going to Mexico and decided to save money by not going out for dinner for 2 months. He saved $300, which he put towards dining out on his Mexican trip.

Look for savings in your:

- Entertainment costs

- Restaurant meals

- Clothes

- Takeaway lunches and coffees

Growing your savings

Once you’ve cut back on your spending, you should make the most of your savings.

Think about putting your money where it will earn interest, such as a term deposit or a savings account. These accounts will give you a higher rate of interest than transaction accounts. Learn more about the compound interest you could earn in a savings account.

Work out how much you will earn in interest if your savings are put in a savings account or term deposit.

It might also help to visualise your holiday so you keep in mind what you are saving for. Our app will help visualise your progress towards achieving your goals.

Track your savings goals on the go with our free app.

Case study: Laura and Kaz save up for Europe

Laura and Kaz dream of backpacking around Europe. They have only 18 months to save as much money as they can for their trip.

Laura and Kaz dream of backpacking around Europe. They have only 18 months to save as much money as they can for their trip.

Laura opens an online savings account with an interest rate of 3% and deposits $500 every fortnight. She resists the temptation to dip into the money as she knows she will lose some of her interest if she does. Kaz saves $500 of her pay every fortnight in her everyday transaction account that has an interest rate of 1.5%. She tries not to use the money but regularly takes out $50 a fortnight to get her through to the next pay day.

Eighteen months later, Laura has saved more than $18,400, while Kaz has only $16,394. Hard-to-access, high interest accounts can make a big difference.

The more money you can save before a holiday, the better. Start saving now by opening a savings account.

Source:

Reproduced with the permission of ASIC’s MoneySmart Team. This article was originally published at www.moneysmart.gov.au

Important note: This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person. Past performance is not a reliable guide to future returns.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for their action or any service they provide.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

Investing: how to reduce concentration risk

Concentration risk. No, it’s nothing to do with thinking too hard about something. In fact, it’s more likely to be a result of not paying enough attention.

Concentration risk is the increase in investment risk that comes about from not sufficiently diversifying your portfolio. In other words, too much money is concentrated in too few assets, sectors or geographical markets.

This can happen:

- Intentionally, because you have a strong belief that a particular share or sector, such as resources, banks or property, is likely to outperform in the future.

- Unintentionally, through asset performance. One or two shares deliver spectacular gains, making the entire portfolio more sensitive to moves in just a couple of assets. Or maybe shares as a whole enjoy a period of strong growth. Even though you hold a large number of different shares, the increased exposure to one asset class increases the risk to your portfolio.

- Accidentally, through poor asset selection. Nine out of the ten top companies that make up the MSCI World Index also appear on the top ten list of the main US index, the S&P 500. Investing in two funds, one that tracks the world market and one that tracks the US market won’t deliver the level of diversification you might expect.

Managing your risk

The solution to concentration risk is our old friend, diversification.

- Appreciate the importance of asset allocation, the art of spreading your money across the main asset classes of shares, property, fixed interest and cash. Ensure your asset allocation matches your tolerance to investment risk.

- Diversify within each asset class. Holding the big four banks is not a diversified share portfolio. If property is your thing, buying four one-bedroom apartments in the same building, or even in the same area, creates a huge concentration risk.

- Rebalance your portfolio to keep it broadly in line with your ideal asset allocation. This may create a tax liability, but often it’s better to pay some tax than to carry too high a level of concentration risk.

- Understand each investment and its role in your portfolio. Does share fund A hold similar shares as share fund B? Do they both have the same strategy?

- Get a professional opinion. Even if you are confident in making your own investment decisions it’s wise to run them by a licensed adviser.

It’s surprisingly common for investors to develop an emotional attachment to particular shares or properties they own. Concentration risk can also increase over time due to lack of attention. Your financial planner will assess your portfolio for hidden concentration risk and help you achieve a better balance of investments.

Please contact us on 03 9836 8399 if you would like to discuss further.

Important:

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee takes any responsibility for their action or any service they provide

May the power be with you

There are ways to ensure financial affairs remain in order if a person is unable to sign important documents. This article explains the various Powers of Attorney arrangements available; their types and uses.

What would happen if you were physically unable to sign important documents or became mentally incapable of making key decisions? This is when a Power of Attorney becomes a vital tool in managing your life – when you are unable to.

Put simply, a Power of Attorney is a legal document that allows another person to act on your behalf. There are three different types of Power of Attorney (POA) arrangements – a General POA, an Enduring POA and Medical POA. The differences are important to note for the purposes of managing your estate.

Types and uses

Under a General Power of Attorney you appoint someone to act for a specific period of time or for a specific purpose. For example, if you are taking an extended trip overseas, you can appoint someone to look after your affairs at home. About the only things your attorney can’t do is to make a will or enter into a contract of marriage on your behalf. A General POA ceases to be effective if you lose your mental capacity.

An Enduring Power of Attorney acts in the same way as a General POA but it has the advantage that if you lose the capacity to make decisions for yourself your attorney will be able to do so. Enduring Powers of Attorney can cover your financial affairs, or, with an Enduring Power of Guardianship, your nominee can also make decisions regarding lifestyle issues, such as where you live.

In many Australian states, a Medical Power of Attorney may also be implemented. These can help to ensure that your wishes in relation to medical treatment will be considered if you are unable to express those instructions yourself.

Appointing or revoking an attorney

Although the person you appoint as your attorney has a legal obligation to act in your best interests, it is obviously important that you trust your nominee and are confident that he or she understands and will respect your wishes. In many cases you can appoint joint attorneys, and even stipulate that they must agree on any decision.

Most people appoint a spouse, partner, adult child or other trusted family member as their attorney. In some cases, professionals such as an accountant or lawyer may fill the role.

Establishing a Power of Attorney

Enduring Powers of Attorney will often be prepared by a lawyer when wills are made, although relevant forms can also be obtained from legal stationers or downloaded from the websites of relevant state government authorities.

A Power of Attorney may be revoked simply by telling your nominee that they are no longer your attorney and the original and all copies of the POA form destroyed.

The rules for Powers of Attorney vary from state to state, so it is always beneficial to seek professional advice when drawing up this important legal document.

For more information about Estate Planning please contact us on 03 9836 8399.

Important:

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee takes any responsibility for their action or any service they provide.

How to refinance to renovate?

Refinancing your assets to renovate a property is a significant decision that will hopefully improve your standard of living or add substantial value to your property.

Refinancing isn’t as straightforward as you might expect. The type of renovation proposed goes a long way to dictating the loan required. If the wrong loan is chosen, you could be left with a pile of unexpected debt.

Know your budget

Before considering refinancing, you need to have a clear idea of your budget.

If you underestimate your budget, you run the risk of getting knocked back from your lender, according to an MFAA accredited finance broker.

“I know a lot of homeowners who have estimated a budget of say $100,000 to do renovations, only to discover it will cost a lot more,” the broker says.

“This means you may have to reapply for the loan, which banks generally don’t like.”

“Be conservative with your projection. If you think you need $100,000, I’d recommend to apply for $150,000 just in case, if you can afford it. The key is stick to your budget,” adds the broker.

The next step is to speak to your broker to determine which loan will suit your needs and objectives.

Line of credit loan (Home equity loan)

Also known as an equity loan, to be eligible, one must be looking to make upgrades to the cosmetic domain of their property.

Installing a new bathroom or kitchen, painting the interior or exterior of the house and other basic construction falls under a line of credit loan.

These renovations, more often than not, do not supersede the costs of structural changes, so homeowners can call on up to 80 per cent of their Loan-to-Value Ratio (LVR).

A line of credit loan is a “revolving door” of credit that combines your home loan, daily spending and savings into one loan.

To calculate the value you can borrow, subtract your current loan balance from your property value and then multiply by 80 per cent. For example, if your property is worth $500,000, and you have $250,000 left on your loan, your home equity is $250,000. You then multiply this total by 80 per cent. If you’re uncertain of your home value, contact an MFAA Accredited Finance Broker who can assist you to arrange for an appraisal or valuation. For MFAA calculators, click here.

If you choose a line of credit home loan, it essentially works as a large credit card. You can use it to purchase cars, cosmetic renovations and other investments. However, the interest-only charge starts when the equity is drawn down.

Keep in mind, line of credit loans provide you with money that can gather interest quickly, so if you are ill disciplined with repayments or money, speak to us on |PHONE| for a plan matches your unique circumstances.

Construction loans

Construction loans are suitable for structural work in your home, for example, if you’re adding a new room or making changes to the roof.

Construction loans give homeowners the opportunity to access larger sums of money, with the amount dependent upon the expected value of the property after renovations are completed.

The advantage of a construction loan is that the interest is calculated on the outstanding amount, not the maximum amount borrowed. This means you have more money available in your kitty, but only pay interest on the money you choose to spend. For this reason, the broker may recommend that you apply for just one loan, but leave some leeway in your borrowed kitty.

When applying for a construction loan, council approval and a fixed price-building contract are required.

Your lender will appoint an assessor to value your construction at each stage of the renovation. This will happen before you pay your instalment. When construction is complete, speak to your mortgage broker as you may be able to refinance back to the loan of your choice.

When looking at both these loans, the broker says consumers can call on other property they own to boost their overall borrowing amount if they wish.

“Depending on the client, they can use other property to get a line of credit and a construction loan. Or they might get a typical construction loan if there is going to be an extensive framework change on the building,” the broker says.

Broker advice

If you speak to a broker they will be able to determine which loan will give you the options you seek. This advice is essential, as a poorly planned construction loan could cost you more down the road.

“Consumers should ask their broker, ‘What type of loan am I eligible for?’, because if you don’t get your construction loan right, you may be jeopardising your bank security,” the broker says.

While these specific options can be discussed with your broker, if they aren’t suitable, there may be other options available to you. Speak to us on |PHONE| to make your grand renovation plans a reality.

For further information or assistance please contact us on 03 9836 8399.

Reproduced with the permission of the Mortgage and Finance Association of Australia (MFAA)

Important note: This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.

Any information provided by MFAA detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for their action or any service they provide.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

Are young investors wasting their youth?

It was George Bernard Shaw who coined the phrase ‘youth is wasted on the young’. In Australia today, it seems the young may be wasting their investing youth.

The great advantage the young – and here we are referring to 18-25 year olds – have over those of us closer to retirement is time.

Time is a powerful investment tool because it gives you the ability to take a long-term view and ride through the inevitable market ups and downs.

Serious market downturns like the 2008 global financial crisis look completely different if viewed through the eyes of a 25-year old versus a 65-year old.

Investment experience suggests the GFC was a buying opportunity for the young and – depending on their asset allocation – a distressing lifestyle changing event for the recently retired.

Which makes the results of the 2017 ASX Australian Investor Study noteworthy. The survey of 4000 investors by Deloitte found that younger Australian investors were highly conservative in their attitude to investment risk.

The ASX survey found that around 31 percent of younger people wanted guaranteed returns and only 19 per cent would accept variability in returns. In contrast only 8 per cent of those surveyed aged over 75 look for guaranteed returns and 35 percent would accept variability in returns.

Interestingly, Australians are more conservative than investors in other countries according a global study of investor risk tolerance done by fund manager Legg Mason in 2015 that found only 29 percent of Australian investors would be prepared to increase their risk profile for the opportunity to gain extra income. Globally 66 percent of investors said they would be prepared to increase risk for the chance of higher yield.

Investing is essentially about getting the risk and return balance right and a key determinant is an investor’s age.

For younger investors their relative youth is an asset that it seems many – paradoxically perhaps given risk-taking behavior more typical of 18-25 year olds – are undervaluing. Although a younger investor might feel more comfortable investing more conservatively, what they may not be considering is the opportunities for growth they are passing up in favour of short-term stability.

Another interesting stat from the survey was that only 37 per cent of young investors used financial advice to help them make investment decisions, compared to 45 per cent for all investors.

Although many investors perceived that going to an adviser was too expensive or perhaps weren’t sure of their value proposition, a good financial adviser who can help an investor determine an appropriate level of risk based on their goals and time horizon, and then help them maintain the discipline and focus to stick to their plan through market ups and downs, could be one of the most valuable investments of all.

For further information or assistance please contact us on 03 9836 8399.

Written by Robin Bowerman, Head of Market Strategy and Communications at Vanguard.

Source:

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2017 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for their action or any service they provide.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

You might be surprised at what really drives interest rates

The Reserve Bank of Australia (RBA) and the major trading banks may play the most visible role in setting interest rates, but in many cases they are being reactive rather than proactive.

A wide range of external factors feed into their decision-making process, including in no small part, our collective behaviour as investors and savers, borrowers and consumers. Then there’s the rate of inflation and wages growth, foreign currency exchange, the economic health of our trading partners, and the interest rates paid by local banks to borrow money from overseas.

Suddenly it’s not so easy to figure out where interest rates are headed, even in the short term.

A fine balance

To look at just one part of the puzzle: the RBA dropped the cash rate to 1.5% in August 2016 – the lowest rate on record. This makes it cheaper for businesses to borrow and invest in job-creating activities. However, mortgage rates also followed the cash rate down, allowing homebuyers and investors to borrow more which subsequently drove up house prices.

So how can the RBA keep a lid on housing costs without choking business activity and consumer spending?

One way is to get by with a little help from its friends, in this case the banking regulator, the Australian Prudential Regulation Authority (APRA).

APRA has imposed a range of restrictions on the banks. These include capping new interest-only lending, and limiting the growth in lending to investors. Lenders are also ordered to keep a tight rein on ‘risky’ loans, for example, where loans exceed 80% of the value of the property.

While APRA’s main motive is to make the banks more resilient to any shocks such as another global financial crisis, a side effect is that the banks will have to reduce the amount they lend for housing. And according to the rule of supply and demand, if less money is available then the cost of that money – the interest rate – will go up.

We are now seeing this happen. Bank mortgage rates have risen, particularly for investors and interest-only loans, even though the RBA’s cash rate has remained unchanged.

Navigating uncertain waters

Appreciating the complexity of interest rates doesn’t always help in deciding how to respond to them. Even the experts often get it wrong when trying to predict where interest rates are going. This doesn’t help answer borrowers’ eternal question: “do I lock in a fixed rate, or opt for a variable rate?”

Locking in current rates provides protection against future mortgage rate rises. In the current low interest rate environment it’s very tempting to fix the rates on at least part of a mortgage, and for as long as possible (usually up to five years).

Of course, if rates fall further, fixed-rate borrowers miss out on a windfall. However, with rates already so low, any falls are likely to be small which can minimise the downside risk.

Still not sure what to do? If your mortgage is due for a review or you’re looking to invest or buy, talk to your licensed financial planner or mortgage broker to get a professional opinion.

Please contact us on 03 9836 8399 if you would like to discuss further.

Important:

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee takes any responsibility for their action or any service they provide