Christmas brings together families and important decisions

As we approach the end of another year many people will be looking forward to the festive season and the chance to slow down and catch up with family, particularly elderly parents. Busy lives and distant homes can make it easy to feel out of touch. Sadly, at this time of year adult children may also begin to notice changes in their ageing parents.

It’s distressing and worrying to accept that your parents who were once vital may soon need help to manage their day to day needs. Hard decisions may need to be made and many children and parents will need professional guidance to convert the mountain of data on aged care into meaningful and relevant information and ultimately into appropriate decisions.

Did you know:

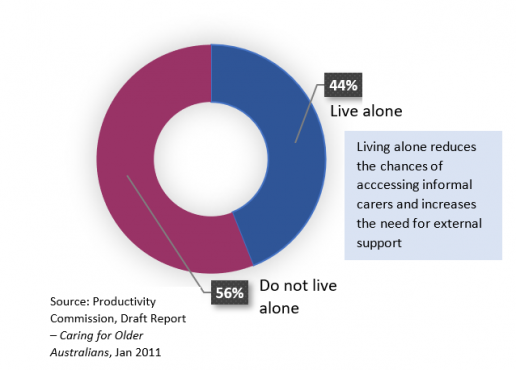

Many older Australians live alone, and families may not notice the decline in an older person’s ability to live independently. The Christmas/New Year period can be a time when families come together and have an opportunity to observe how well a parent is coping.

It might be time for a family meeting

The New Year is traditionally a time to take stock and plan ahead. If you have elderly parents, this year’s planning should include family discussions to help parents plan ahead for the help they may need.

If you are in fact that elderly parent, Christmas time provides you an opportunity to discuss your care needs with your adult children. Make yourself heard. Have these discussions earlier whilst you are still able to maintain your control and independence, to anticipate how your need for care may increase. Christmas time might be one of the few opportunities during the busy year for discussions with all those people who are important to you.

If thought of this discussion fills you with dread, the support and advice of an Accredited Aged Care Professional ™ may prove invaluable.

The value of a family meeting

A family meeting is often an essential step in planning for aged care and may help to minimise conflicts within your family. Emotional conflicts between family members can make the transition to care more distressing for an elderly parent and have the potential to rip families apart.

A well-run family meeting can allow parents, children and other family members to discuss issues and preferences, express concerns and make decisions that work for your family as a whole.

As an Accredited Aged Care Professional ™ I can assist with arranging and running a family meeting to help your family see the big picture more objectively. I can provide a neutral voice in what can be an overwhelmingly emotional discussion, so you can consider the best options for your parents’ care, security and happiness.

The earlier you take this step, the better. Planning ahead ensures that parents are fully involved in the decision-making and removes some of the stress from other family members. With a well organised plan in place, your family can respond more quickly and effectively when an event requiring a move to aged care occurs.

Talk to me today.

Emmett Wilkinson is an ACS Accredited Aged Care Professional™ and can take away a lot of the stress and complexity of the aged care process.

Aged Care Changes in 2018 Federal Budget

The Federal Budget has come and gone and the main take out as far as residential aged care fees are concerned is that there were no major changes.

Still the same:

Before listing some of the aged care related changes that were in the budget it’s worth re-iterating that:

The RAD/RAC & DAP/DAC system stays as it is currently.

The Basic Daily Care Fee remains as is currently: $50.16 per day (85% of single basic pension rate).

Means Tested Fee annual and lifetime caps remain in place: currently $26,964.71 and $64,715.36 respectively.

Changes:

Home Care packages up: An additional 14,000 packages (expected to be at Level 3 & Level 4) over the next 4 years.

RADs & RACs are still guaranteed if paid to an approved provider however there will be a levy imposed on all Aged Care Providers if defaults are greater than $3 million in a financial year.

The DHS’s Permanent Residential Aged Care Request for a Combined Assets and Income Assessment form (SA 457) is to be simplified and a new form in use by May 2019

Funds are being allocated to streamline the ACAS/ACAT assessment process and also towards improving the My Aged Care website.

There will be a trial of four programs involving information and community hubs aimed at improving consumer understanding of the aged care system.

The new Aged Care Quality & Safety Commission will commence from 1 January 2019 and will receive additional funding to enhance regulation of aged care.

Additional funding has been proposed to introduce 13,500 new residential care places and 775 short term restorative aged care services in 2018/19.

To encourage providers to build new aged care services, $60 million will be allocated towards capital investment for new places. Another $40 million will be allocated to providers in regional, rural and remote areas for construction and improvement, plus $105 million for aged care services in remote indigenous communities.

Additional funding will be allocated for palliative care services in residential care (subject to matched funding from the states and territories) as well as innovations in managing dementia and mental health programs for older Australians.

Victorian State Budget 2018

Speaking of budgets, last week’s Victorian State Budget had an interesting inclusion relating to future aged care workers.

From 1 January 2019 students will pay no tuition fees for 30 priority non-apprenticeship TAFE courses. Included in the list are several relevant to carers roles such as the Certificate IV in Ageing Support, Certificate IV in Disability and the Diploma of Nursing.

A good initiative I reckon!

Regards

Emmett

They deserve nothing less

They deserve nothing less

A move into residential aged care often involves major financial decisions being made under difficult circumstances. The support of an adviser who specializes in these matters and who can explain your options and their implications in an impartial and professional manner is desirable if not essential.

The ever-increasing life-expectancy we are enjoying brings with it the downside that many of us will experience debilitating illness in our later years. In particular the incidence of Dementia related illnesses has risen significantly and 80% of older Australians will access some form of community or residential aged care service[1].

The government has responded with financial support for residential aged care and a range of home-care support packages. Assisting a parent or relative or friend’s admission into residential care is often emotionally very challenging; navigating Centrelink, DVA & DHS regulations as well as having to choose a suitable facility can be extremely stressful.

A move into residential aged care often involves major financial decisions being made under difficult circumstances. The support of an adviser who specializes in these matters and who can explain your options and their implications in an impartial and professional manner is desirable if not essential.

When you first set foot in the Aged Care financial world you will find yourself confronted with a bewildering array of specialist terms each with its own 3-letter acronym. The fees associated with entering a facility are called a Refundable Accommodation Deposit (RAD) or Refundable Accommodation Contribution (RAC) which can be paid as a Daily Accommodation Payment (DAP) or Daily Accommodation Contribution (DAC).

The RAD is a lump sum payable to the facility for the right to occupy a room on their premises. It is important to understand that the resident will not own the room. The RAD which can range from $200,000 to over $1,000,000 will be repaid when the resident leaves the facility and is government guaranteed. Many factors influence the size of the RAD and all approved aged care facilities are required to list their RAD on the Commonwealth Government’s website – myagedcare.gov.au.

The entrant into care must deal with two financial issues: funding the RAD and ongoing cash-flow.

The RAD may be paid in full or in part with interest at a prescribed rate being payable on any outstanding balance. How to fund the RAD is one of the critical issues to be addressed by a specialist adviser. Options can include liquidating investments, borrowing, selling the family home or retaining it and renting it out. Each option has significant ramifications for other costs and government benefits.

Ongoing costs can include as many as five elements.

- If the RAD is not paid in full, there will be a continuing interest payment (DAP)

- All residents will pay a Basic Daily Fee which is set at 85% of the daily full rate age pension (currently $50.16). This rate applies irrespective of whether the resident actually receives an age pension.

- Some residents will be required to pay a Means Tested Fee (MTF) which is calculated under a formula taking into consideration both the resident’s assets and income. This fee can be as high as $245 per day.

- Fourthly some facilities charge what is called an Extra Services Fee. This allows access to a wider range of menu options, wine/beer with meals, cable TV and onsite facilities such as hairdressing. Not all facilities offer extra services but for some of those that do this is a mandatory fee.

- Finally, residents and their families may need to provide an additional sum for discretionary expenditure.

The total daily fees are tallied and the resident is billed monthly. Invoices of $1000 to $4000 are not unusual and reflect the chosen facility and the resident’s financial means. If a resident is in receipt of the Aged Pension or a Department of Veterans Affairs Pension then decisions made about how to fund the RAD and the ongoing daily fees can also affect the level of pension received.

Entering Residential Care is one of the biggest and most complex financial transactions most people will be involved in. Making the right choices will have a big impact on the family’s peace of mind and the resident’s comfort. They deserve nothing less.

Advisersure Financial Consultants is an Accredited Aged Care Professional practice specialising in aged care advice and is Corporate Authorised Representative No. 424041 of MyPlanner Professional Services Pty Ltd ABN 51 159 696 830 AFSL No. 425542

[1] Australian Institute of Health and Welfare: Australia’s welfare 2015