Planning your aged care needs

The wave of older Australians will continue to grow over the coming decades. As such, we can no longer afford to ignore the issues around aged care with over 1 million retirees already accessing aged care services in Australia.

Planning ahead can help to demystify aged care and reduce stress levels. With awareness and pre-planning, you can maintain control and choice, have access to the financial resources to pay for care and minimise the stress on you and your family. This article discusses the steps you should consider when planning to move to residential aged care.

Step 1 – Plan ahead

We are often reluctant to think about a potential move into care. This means we fail to plan and ignore the warning signs until a crisis emerges. At this point, the time available to evaluate options is limited and decisions may be rushed. Also, our families may start to argue and conflicts arise.

|

Tip: Start with a family meeting to make shared decisions. Use this meeting to: · Discuss options and preferences · Explore each person’s concerns · Decide who needs to be involved in any planning

Frank and open discussion is the first step to an effective decision-making process.

Ask your adviser to facilitate your family meeting. He/she can provide advice as well as offer an impartial and objective view. |

Step 2 – Assessing options

Aged care help can be accessed in your home or in a residential service. To help you decide which option is best, arrange a free assessment by an Aged Care Assessment Team/Service (ACAT/ACAS).

You will need to have ACAT/ACAS approval before you can access a government subsidised home care package or residential care.

|

Tip: You can book an appointment directly with ACAT/ACAS on 1800 200 422. Further information is available at www.myagedcare.gov.au |

Step 3 – Searching for services

If residential care is required, think about what criteria is important in deciding where to live. Make a list. This should include location, amenities and your health care needs.

This list will help you develop a shortlist of potential services which you might like to contact or visit. But first check what fees will be asked for accommodation and ongoing services to ensure it is affordable for you.

Once you have selected your preferences you can fill in an application form to add your name to the waiting list. You can put your name on the waiting list for more than one service to increase your chances of finding a place.

|

Tip: You can search for services by · Visiting myagedcare.gov.au and search by postcode for the list of aged care facilities in your preferred location · Searching the internet for ‘aged care placement services’ for advice and help to choose a service and negotiate a place

If you would like to fill in an application form to apply for a place, you can use the generic form which is available from myagedcare.gov.au |

Step 4 – Understanding the fee structure

Most people are often surprised by the level and range of fees. How much you have to pay may depend on:

- The service you choose

- Your assessable assets

- Your assessable income

Your adviser can help you to understand the fees as the total amount payable can be hard to calculate without good advice.

|

Tip: What you will pay for residential care is divided into contributions towards accommodation, care and additional services: · Paying for accommodation – we all need to either find a lump sum of money to buy a home or generate income to rent a home. Residential care is firstly accommodation that needs to be “purchased” (refundable accommodation deposit) or “rented” (daily accommodation payment). · Paying for basic living expenses – food, electricity, cleaning and laundry services and nursing assistance is subsidised by the government. Residents are asked to contribute to the cost through a basic daily care fee plus a means-tested fee for those who have a higher capacity to pay. · Luxuries and lifestyle – additional items can be purchased on a user pays basis or in bundled packages as additional service fees. |

Step 5 – Structuring finances

Accommodation costs are set by market forces with prices published on the MyAgedCare website. But if assets and income can be reduced to low enough levels (to become a low-means client) before the move, the government may subsidise accommodation and regulate how much the resident pays.

In this way, the accommodation cost may be cheaper, but is not always better. Choice and control may be lost. Residents may be faced with accepting a place in whichever service has a low-means place available and could even be a shared room.

|

Tip: A homeowner will generally not qualify as low-means unless their spouse (or other protected person) will continue to live in that home.

If potential residents wish to aim for entry under the low-means rules, there are not many pre-planning strategies to reduce assets. One option may be to enter into a granny flat arrangement to transfer ownership of the home to a child in exchange for a life interest to live in the home.

If this transaction occurs within five years before a move into residential care it could be captured under gifting and deprivation rules (depending on circumstances). Instead of being a solution it could create more problems. Other legal issues also need to be considered to minimise the family problems that could arise. |

Your adviser can review your full financial situation and provide advice on how to:

- Make appropriate decisions

- Structure assets to pay for accommodation and as well as create sufficient cashflow

- Minimise fees or maximise Centrelink or Veterans’ Affairs benefits

Step 6 – Estate planning

Anytime your circumstances change it is important to consider the impact this has on your estate plans. This includes when you move into aged care.

You should speak to your solicitor about the ability to review and redraft your will to reflect your wishes.

As dementia is a leading factor behind the need for care services, when the time comes it is likely that the client will need to delegate financial decisions to someone else. This is easier if an enduring power of attorney (and guardianship) is in place. So it is important to have the appropriate powers in place before a person has lost legal capacity as once capacity has been lost, it will be too late to set up the powers and a trip to the Guardianship Tribunal will be needed.

|

The statistics: · On average, one new case of dementia occurs in Australia every 6 minutes · 30% of people over age 85 have dementia · More than 50% of people in subsidised aged care facilities have dementia

Source: Alzheimers’ Australia, www.fightdementia.org.au Disclaimer: The information in this article is general and does not take into account your particular circumstances. We recommend specific tax or legal advice be sought before any action is taken and refer to the relevant Product Disclosure Statement before investing in any product

|

Aged Care Insights Spring 2018

The cost of aged care in retirement

Planning your retirement is likely to be exciting. While it may be less fun to think about the potential for physical and cognitive decline in the later part of retirement – our frailty years – this is an important period to plan for if we want to maintain independence for as long as possible.

The reality is that we are all likely to experience some cognitive decline or lose some of our physical ability as we age. This is a natural process but does not mean we will all develop dementia or lose the ability to live independently.

It does mean however, that at some point we may need to ask for help with our normal activities of daily living. This might be help we access in our own home. Or we might need to move into residential care for a higher level of support.

What should I plan for?

Figures from the Australian Institute of Health and Welfare[1] estimate that on average approximately 17-25% of your retirement years could be “frailty years”.

|

Example:

If you expect a potential of 30 years in retirement, on average the frailty years would represent 5-7 years. Planning for this length of time and planning early enough might help you to have the resources to pay for care and prevent leaving the planning until crisis point. |

If asked, most of us would prefer to stay in our own homes as we age. Staying at home may be possible if we have lower care needs or we can rely on the support of a capable spouse/family or if we have sufficient financial resources to pay for help at home.

But if our care needs are too high for the people around us to cope, or we don’t have support networks, residential care might be a better option.

In any case, planning the financial aspects of your retirement should also include an estimate of how much you might need to pay for care. This is difficult to calculate because of the unknown factors around health, opportunities and finances.

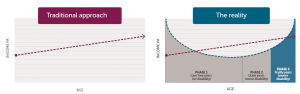

Historically, the approach to retirement planning has been to decide what income you need and then calculate how much you need to save to generate this income. Most people assume a flat (or declining) level of income which grows with inflation. However, if you consider the cost of care, the pattern is more likely to follow an upwards curve as shown in the graph below.

In your early retirement years, you may spend more on leisure activities. This spending may decline as you age but is likely to be replaced with the costs of care or to pay someone to do the activities you used to do yourself.

What does care cost?

The costs of aged care have been increasing and opportunities expanding. The government is increasingly focused on helping to expand and improve the home care opportunities

Australia has a good system of care compared to many other countries, with safety nets to ensure people with lower financial capabilities can access care. But the ability to choose and the options available may be more limited if relying on the low-means concessions.

How much you will need to pay can be difficult to predict. Currently, it can roughly vary from $100 a week to $6,000 a week depending on the options chosen. This covers the wide-range of opportunities from basic home care packages to full-time nursing care at home.

Access to government subsidies and rules for calculating the fees based on your finances helps to make care affordable, but having adequate savings opens up your choices and your ability to control the level and type of care you receive.

| Home care packages | Residential care | |

| What you might pay | $3,767 – $14,553 per year* | $18,308 – $45,273 per year* |

| What government might pay | Up to $50,286 per year | Up to $90,794 per year |

* Additional service fees may also apply if selected and agreed with the service provider

These figures are current to 19 September 2018 and only cover the cost of care. Regardless of which option you choose you also have the costs of accommodation and other personal expenses.

What should I start thinking about?

While you don’t know what your future holds, with some planning you can help to make your retirement a comfortable one and live it the way you choose.

Some of the things you can start to do include:

- Ensure you have a safe and secure income in place for life – this might be pension income, lifetime income streams or drawdown strategies from other investments.

- Include your home as a financial resource available to provide a safe place to live – this might be a physical building but it might also be access to equity to pay for care needs by drawing regular income under an equity release arrangement or renting to generate extra income if you move into residential care or selling to access the sale proceeds for other purposes.

- Consider the impact you would have on family and friends if relying on them to provide care and how you can help with financial support.

Planning to make sure you have resources available is important. Equally important is to ensure you have an Enduring Power of Attorney in place in case someone else needs to take on the responsibility of making the decisions and paying the bills on your behalf.

How do I get help?

Advisersure specialises in aged care advice and matters to help provide our clients with a full retirement planning service. Ask us today for how we can help you plan for a secure and comfortable retirement throughout all phases of your retirement – including the frailty years.

Call 03 98368399

Or email us at info@advisersure.com.au

Dementia Awareness Month

Did you know that dementia is now the second leading cause of death in Australia, and is the leading cause of death for women? Become involved in Dementia Awareness Month.

Dementia is not just one illness, but rather is described by Dementia Australia as the progressive decline in a person’s functioning that may result in a loss of memory, rationality, social skills or physical functioning. It is a broad term and there are many types of dementia.

Dementia mostly affects people over age 80 but can also be experienced at a younger age. Every three seconds someone in the world develops dementia. In Australia there are around 250 new cases every day, with 30% of Australians over age 85 experiencing dementia.

Caring for someone with advanced signs of dementia can be difficult and the carers need lots of support. In the advanced stages, more specialised care and a move into a residential care service may be needed.

Each year in September, Dementia Australia run Dementia Awareness Month to encourage greater awareness and understanding of dementia. The focus this year is on Small actions Big difference with the key message that we can all take small actions to create big differences for the people impacted by dementia as well as their families and carers.

Contact Dementia Australia to become involved or find out more about the resources available to help people experiencing dementia or the people who are close to them.

Website: www.dementia.org.au

Did you know?

Creating a funding plan to cover the increasing costs of care may allow greater independence and control. Plan ahead and consider the costs in your home or residential care.

Quick facts:

- There are currently around 425,416 Australians living with dementia

- While three in every 10 people over age 85 have dementia, over 26,000 people have younger onset dementia

- If dementia were a country, it would be the world’s 18th largest economy

- In 2018, dementia is estimated to cost Australia more than $15 billion. This is expected to increase to more than $36.8 billion by 2056

- The total estimated worldwide costs of dementia were US$818 billion in 2015

- Dementia is now the second leading cause of death in Australia. In 2016, an average of 36 people died per day with dementia identified as the underlying cause of death

- Dementia is the greatest cause of disability in Australians aged 65 or over

- Over half of the people in residential care facilities experience dementia.

https://www.dementia.org.au/statistics

[1] AIHW 2017 report Life expectancy and disability in Australia: expected years living with and without disability, based on expectancies of a 65-year-old.