Christmas brings together families and important decisions

December 19, 2018Residential Aged Care

As we approach the end of another year many people will be looking forward to the festive season and the chance to slow down and catch up with family, particularly elderly parents. Busy lives and distant homes can make it easy to feel out of touch. Sadly, at this time of year adult children may also begin to notice changes in their ageing parents.

It’s distressing and worrying to accept that your parents who were once vital may soon need help to manage their day to day needs. Hard decisions may need to be made and many children and parents will need professional guidance to convert the mountain of data on aged care into meaningful and relevant information and ultimately into appropriate decisions.

Did you know:

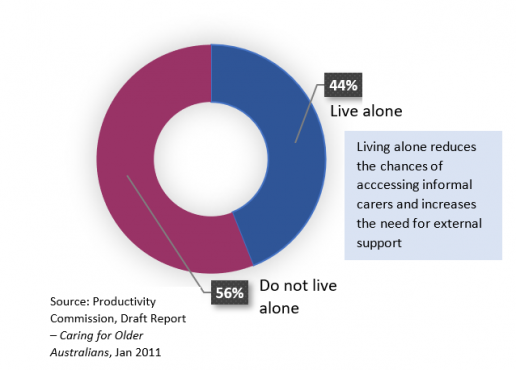

Many older Australians live alone, and families may not notice the decline in an older person’s ability to live independently. The Christmas/New Year period can be a time when families come together and have an opportunity to observe how well a parent is coping.

It might be time for a family meeting

The New Year is traditionally a time to take stock and plan ahead. If you have elderly parents, this year’s planning should include family discussions to help parents plan ahead for the help they may need.

If you are in fact that elderly parent, Christmas time provides you an opportunity to discuss your care needs with your adult children. Make yourself heard. Have these discussions earlier whilst you are still able to maintain your control and independence, to anticipate how your need for care may increase. Christmas time might be one of the few opportunities during the busy year for discussions with all those people who are important to you.

If thought of this discussion fills you with dread, the support and advice of an Accredited Aged Care Professional ™ may prove invaluable.

The value of a family meeting

A family meeting is often an essential step in planning for aged care and may help to minimise conflicts within your family. Emotional conflicts between family members can make the transition to care more distressing for an elderly parent and have the potential to rip families apart.

A well-run family meeting can allow parents, children and other family members to discuss issues and preferences, express concerns and make decisions that work for your family as a whole.

As an Accredited Aged Care Professional ™ I can assist with arranging and running a family meeting to help your family see the big picture more objectively. I can provide a neutral voice in what can be an overwhelmingly emotional discussion, so you can consider the best options for your parents’ care, security and happiness.

The earlier you take this step, the better. Planning ahead ensures that parents are fully involved in the decision-making and removes some of the stress from other family members. With a well organised plan in place, your family can respond more quickly and effectively when an event requiring a move to aged care occurs.

Talk to me today.

Emmett Wilkinson is an ACS Accredited Aged Care Professional™ and can take away a lot of the stress and complexity of the aged care process.

Planning your aged care needs

The wave of older Australians will continue to grow over the coming decades. As such, we can no longer afford to ignore the issues around aged care with over 1 million retirees already accessing aged care services in Australia.

Planning ahead can help to demystify aged care and reduce stress levels. With awareness and pre-planning, you can maintain control and choice, have access to the financial resources to pay for care and minimise the stress on you and your family. This article discusses the steps you should consider when planning to move to residential aged care.

Step 1 – Plan ahead

We are often reluctant to think about a potential move into care. This means we fail to plan and ignore the warning signs until a crisis emerges. At this point, the time available to evaluate options is limited and decisions may be rushed. Also, our families may start to argue and conflicts arise.

|

Tip: Start with a family meeting to make shared decisions. Use this meeting to: · Discuss options and preferences · Explore each person’s concerns · Decide who needs to be involved in any planning

Frank and open discussion is the first step to an effective decision-making process.

Ask your adviser to facilitate your family meeting. He/she can provide advice as well as offer an impartial and objective view. |

Step 2 – Assessing options

Aged care help can be accessed in your home or in a residential service. To help you decide which option is best, arrange a free assessment by an Aged Care Assessment Team/Service (ACAT/ACAS).

You will need to have ACAT/ACAS approval before you can access a government subsidised home care package or residential care.

|

Tip: You can book an appointment directly with ACAT/ACAS on 1800 200 422. Further information is available at www.myagedcare.gov.au |

Step 3 – Searching for services

If residential care is required, think about what criteria is important in deciding where to live. Make a list. This should include location, amenities and your health care needs.

This list will help you develop a shortlist of potential services which you might like to contact or visit. But first check what fees will be asked for accommodation and ongoing services to ensure it is affordable for you.

Once you have selected your preferences you can fill in an application form to add your name to the waiting list. You can put your name on the waiting list for more than one service to increase your chances of finding a place.

|

Tip: You can search for services by · Visiting myagedcare.gov.au and search by postcode for the list of aged care facilities in your preferred location · Searching the internet for ‘aged care placement services’ for advice and help to choose a service and negotiate a place

If you would like to fill in an application form to apply for a place, you can use the generic form which is available from myagedcare.gov.au |

Step 4 – Understanding the fee structure

Most people are often surprised by the level and range of fees. How much you have to pay may depend on:

- The service you choose

- Your assessable assets

- Your assessable income

Your adviser can help you to understand the fees as the total amount payable can be hard to calculate without good advice.

|

Tip: What you will pay for residential care is divided into contributions towards accommodation, care and additional services: · Paying for accommodation – we all need to either find a lump sum of money to buy a home or generate income to rent a home. Residential care is firstly accommodation that needs to be “purchased” (refundable accommodation deposit) or “rented” (daily accommodation payment). · Paying for basic living expenses – food, electricity, cleaning and laundry services and nursing assistance is subsidised by the government. Residents are asked to contribute to the cost through a basic daily care fee plus a means-tested fee for those who have a higher capacity to pay. · Luxuries and lifestyle – additional items can be purchased on a user pays basis or in bundled packages as additional service fees. |

Step 5 – Structuring finances

Accommodation costs are set by market forces with prices published on the MyAgedCare website. But if assets and income can be reduced to low enough levels (to become a low-means client) before the move, the government may subsidise accommodation and regulate how much the resident pays.

In this way, the accommodation cost may be cheaper, but is not always better. Choice and control may be lost. Residents may be faced with accepting a place in whichever service has a low-means place available and could even be a shared room.

|

Tip: A homeowner will generally not qualify as low-means unless their spouse (or other protected person) will continue to live in that home.

If potential residents wish to aim for entry under the low-means rules, there are not many pre-planning strategies to reduce assets. One option may be to enter into a granny flat arrangement to transfer ownership of the home to a child in exchange for a life interest to live in the home.

If this transaction occurs within five years before a move into residential care it could be captured under gifting and deprivation rules (depending on circumstances). Instead of being a solution it could create more problems. Other legal issues also need to be considered to minimise the family problems that could arise. |

Your adviser can review your full financial situation and provide advice on how to:

- Make appropriate decisions

- Structure assets to pay for accommodation and as well as create sufficient cashflow

- Minimise fees or maximise Centrelink or Veterans’ Affairs benefits

Step 6 – Estate planning

Anytime your circumstances change it is important to consider the impact this has on your estate plans. This includes when you move into aged care.

You should speak to your solicitor about the ability to review and redraft your will to reflect your wishes.

As dementia is a leading factor behind the need for care services, when the time comes it is likely that the client will need to delegate financial decisions to someone else. This is easier if an enduring power of attorney (and guardianship) is in place. So it is important to have the appropriate powers in place before a person has lost legal capacity as once capacity has been lost, it will be too late to set up the powers and a trip to the Guardianship Tribunal will be needed.

|

The statistics: · On average, one new case of dementia occurs in Australia every 6 minutes · 30% of people over age 85 have dementia · More than 50% of people in subsidised aged care facilities have dementia

Source: Alzheimers’ Australia, www.fightdementia.org.au Disclaimer: The information in this article is general and does not take into account your particular circumstances. We recommend specific tax or legal advice be sought before any action is taken and refer to the relevant Product Disclosure Statement before investing in any product

|

Aged Care Insights Spring 2018

The cost of aged care in retirement

Planning your retirement is likely to be exciting. While it may be less fun to think about the potential for physical and cognitive decline in the later part of retirement – our frailty years – this is an important period to plan for if we want to maintain independence for as long as possible.

The reality is that we are all likely to experience some cognitive decline or lose some of our physical ability as we age. This is a natural process but does not mean we will all develop dementia or lose the ability to live independently.

It does mean however, that at some point we may need to ask for help with our normal activities of daily living. This might be help we access in our own home. Or we might need to move into residential care for a higher level of support.

What should I plan for?

Figures from the Australian Institute of Health and Welfare[1] estimate that on average approximately 17-25% of your retirement years could be “frailty years”.

|

Example:

If you expect a potential of 30 years in retirement, on average the frailty years would represent 5-7 years. Planning for this length of time and planning early enough might help you to have the resources to pay for care and prevent leaving the planning until crisis point. |

If asked, most of us would prefer to stay in our own homes as we age. Staying at home may be possible if we have lower care needs or we can rely on the support of a capable spouse/family or if we have sufficient financial resources to pay for help at home.

But if our care needs are too high for the people around us to cope, or we don’t have support networks, residential care might be a better option.

In any case, planning the financial aspects of your retirement should also include an estimate of how much you might need to pay for care. This is difficult to calculate because of the unknown factors around health, opportunities and finances.

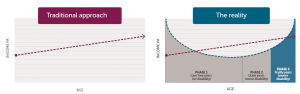

Historically, the approach to retirement planning has been to decide what income you need and then calculate how much you need to save to generate this income. Most people assume a flat (or declining) level of income which grows with inflation. However, if you consider the cost of care, the pattern is more likely to follow an upwards curve as shown in the graph below.

In your early retirement years, you may spend more on leisure activities. This spending may decline as you age but is likely to be replaced with the costs of care or to pay someone to do the activities you used to do yourself.

What does care cost?

The costs of aged care have been increasing and opportunities expanding. The government is increasingly focused on helping to expand and improve the home care opportunities

Australia has a good system of care compared to many other countries, with safety nets to ensure people with lower financial capabilities can access care. But the ability to choose and the options available may be more limited if relying on the low-means concessions.

How much you will need to pay can be difficult to predict. Currently, it can roughly vary from $100 a week to $6,000 a week depending on the options chosen. This covers the wide-range of opportunities from basic home care packages to full-time nursing care at home.

Access to government subsidies and rules for calculating the fees based on your finances helps to make care affordable, but having adequate savings opens up your choices and your ability to control the level and type of care you receive.

| Home care packages | Residential care | |

| What you might pay | $3,767 – $14,553 per year* | $18,308 – $45,273 per year* |

| What government might pay | Up to $50,286 per year | Up to $90,794 per year |

* Additional service fees may also apply if selected and agreed with the service provider

These figures are current to 19 September 2018 and only cover the cost of care. Regardless of which option you choose you also have the costs of accommodation and other personal expenses.

What should I start thinking about?

While you don’t know what your future holds, with some planning you can help to make your retirement a comfortable one and live it the way you choose.

Some of the things you can start to do include:

- Ensure you have a safe and secure income in place for life – this might be pension income, lifetime income streams or drawdown strategies from other investments.

- Include your home as a financial resource available to provide a safe place to live – this might be a physical building but it might also be access to equity to pay for care needs by drawing regular income under an equity release arrangement or renting to generate extra income if you move into residential care or selling to access the sale proceeds for other purposes.

- Consider the impact you would have on family and friends if relying on them to provide care and how you can help with financial support.

Planning to make sure you have resources available is important. Equally important is to ensure you have an Enduring Power of Attorney in place in case someone else needs to take on the responsibility of making the decisions and paying the bills on your behalf.

How do I get help?

Advisersure specialises in aged care advice and matters to help provide our clients with a full retirement planning service. Ask us today for how we can help you plan for a secure and comfortable retirement throughout all phases of your retirement – including the frailty years.

Call 03 98368399

Or email us at info@advisersure.com.au

Dementia Awareness Month

Did you know that dementia is now the second leading cause of death in Australia, and is the leading cause of death for women? Become involved in Dementia Awareness Month.

Dementia is not just one illness, but rather is described by Dementia Australia as the progressive decline in a person’s functioning that may result in a loss of memory, rationality, social skills or physical functioning. It is a broad term and there are many types of dementia.

Dementia mostly affects people over age 80 but can also be experienced at a younger age. Every three seconds someone in the world develops dementia. In Australia there are around 250 new cases every day, with 30% of Australians over age 85 experiencing dementia.

Caring for someone with advanced signs of dementia can be difficult and the carers need lots of support. In the advanced stages, more specialised care and a move into a residential care service may be needed.

Each year in September, Dementia Australia run Dementia Awareness Month to encourage greater awareness and understanding of dementia. The focus this year is on Small actions Big difference with the key message that we can all take small actions to create big differences for the people impacted by dementia as well as their families and carers.

Contact Dementia Australia to become involved or find out more about the resources available to help people experiencing dementia or the people who are close to them.

Website: www.dementia.org.au

Did you know?

Creating a funding plan to cover the increasing costs of care may allow greater independence and control. Plan ahead and consider the costs in your home or residential care.

Quick facts:

- There are currently around 425,416 Australians living with dementia

- While three in every 10 people over age 85 have dementia, over 26,000 people have younger onset dementia

- If dementia were a country, it would be the world’s 18th largest economy

- In 2018, dementia is estimated to cost Australia more than $15 billion. This is expected to increase to more than $36.8 billion by 2056

- The total estimated worldwide costs of dementia were US$818 billion in 2015

- Dementia is now the second leading cause of death in Australia. In 2016, an average of 36 people died per day with dementia identified as the underlying cause of death

- Dementia is the greatest cause of disability in Australians aged 65 or over

- Over half of the people in residential care facilities experience dementia.

https://www.dementia.org.au/statistics

[1] AIHW 2017 report Life expectancy and disability in Australia: expected years living with and without disability, based on expectancies of a 65-year-old.

The Amazing Royal Commission

“I have been astonished by the revelations of the incompetence, arrogance and venality of the boards and senior management of these institutions”

Dear Client Unless you’ve been 4-wheel driving through the red centre, you would be aware that the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry has been sitting in Melbourne for the past few weeks and every day it seems new ghastly revelations emerge. If this disturbs and worries you it is understandable. I would like to provide some context for you and, I hope, some reassurance about the industry in general and Advisersure in particular. I will mostly focus on the financial advice sector but I will also make some comment on the banking industry.

The Royal Commission’s brief has seen it examining institutions with regard to breaches and failings that have occurred over recent years. To an extent, many of the cases that have been brought up have been reported previously when they first came to light. That so many horror stories are being given headline treatment at one time can perhaps give the impression of the whole industry being a cesspool of incompetents, cowboys and shonks. This would be a false picture. However, I do not, for one minute want to give the idea that I believe there aren’t a lot of things wrong and hopefully this Commission will finally force politicians and regulators to fix some of these problems.

Over more than 30 years there have been a number of commissions and reviews resulting in regulatory changes and it is clear that critical failings have not been addressed. In my view 3 things should have been implemented 20 years ago and should be implemented now:

- Firstly all advisers should have been licensed and specific competencies should have been subject to license endorsement; it is ridiculous that an adviser with only basic level competency can advise on Self Managed Super or multimillion dollar investments.

- Secondly commissions on everything except risk insurance should have been outlawed; this finally occurred in 2013 when FOFA was introduced.

- Thirdly, there should be a clear separation between owners and promoters of product and firms delivering advice. So called vertical integration is a major problem.

Implementation of these three measures would not have eliminated all the problems we have seen but would have gone a long way to preventing disasters like Gunns and Great Southern, Westpoint and Storm Financial for instance. Well the politicos, undoubtedly heavily influenced by the Big Banks, failed at every step with the results we see today.

With that background in mind let me offer a bit of context to what we are now seeing. There are perhaps 25,000 authorized advisers in Australia; many are decent and honest and caring. Unfortunately over 45% of them are authorized through large institutions such as major banks, industry funds and firms like AMP. This has resulted in a product-sales focus allied to very moderate competency and poor supervision. We have known this for many years; it is now coming as a revelation at the Royal Commission. There are good advisers working in the institutionally owned licenses but unfortunately tens of thousands of clients will have received second rate advice from the majority. And just because an adviser is not aligned to a big institution doesn’t guarantee quality although it may improve the odds.

Now I’d like to say a few words about Advisersure. Our philosophy is based on the belief that we should deliver the best and most relevant advice that we can to our clients. Achieving that over many years has required us to take a number of steps:

- Licensing – we have always chosen to work with licensees whose philosophy aligns with ours. We have changed licensees on two occasions when they have become institutionally owned resulting in pressure being brought on us to “sell” product. We are currently licensed through the privately owned MyPlanner Professional; we are largely unconstrained as to the advice we give.

- Qualifications – our advisers and staff are qualified to advise in the areas our clients need. SMSFs are an important part of our business so I have been a Specialist Adviser (SSA) since the designation was first available. Emmett gives Aged Care advice so he is an Accredited Aged Care Specialist. Both Emmett and I hold the Certified Financial Planner (CFP) qualification.

- Training – we seem to never stop learning. A major flaw of the vertically integrated model is that advisers live in the licensee’s bubble and are fed only what the licensee sees fit to feed them. We have consciously sought education from the widest and the best sources. We always attend the Portfolio Construction Conference and Summit – widely recognized as the best source of knowledge in the investment world. We always attend the SMSF Conference and also seminars run by Grant Abbott and other leading SMSF and Estate Planning Specialists. This takes a lot of time and costs a lot of money but we believe it is essential if we are to serve you effectively.

- Transparency – we decided to switch to a fee-only model 20 years ago and we receive no commissions or kickbacks from any product we recommend except risk insurance and that’s only because the products do not lend themselves to commission rebating. We also decided years ago to stop using administration platforms as they serve their promoters and advisers well but they are just a cost to clients.

- Network – we know we can’t know everything so over the years we have built connections with a network of experts in tax, superannuation and law as well as many other niche areas that affect our clients’ lives.

Finally I’d like to offer some comment on the major banks and AMP. Perhaps I am naïve but while I never expected the big institutions to act in their clients’ best interests I admit I have been astonished by the revelations of the incompetence, arrogance and venality of the boards and senior management of these institutions. They deserve everything they will get and probably more.

So where to from here? There will be still more revelations and upheaval. Hopefully, at the end of the day, we will have a better structured industry but perhaps I can be forgiven for some doubt that this will happen. What is good is that the spotlight of public and shareholder opinion is shining fiercely of the management of these organizations and the regulators are stepping up and taking action. Let’s hope the pollies actually get it right for once.

At Advisersure we will continue to do the best we can for our clients; if you have any questions or comments please call me.

Special Offer

We too are disturbed by what has been reported and we know there are people who are very concerned about their position. If you have friends or relatives who are worried about the advice they have received we would like to offer them a free health check on the advice they have received.

Aged Care Changes in 2018 Federal Budget

The Federal Budget has come and gone and the main take out as far as residential aged care fees are concerned is that there were no major changes.

Still the same:

Before listing some of the aged care related changes that were in the budget it’s worth re-iterating that:

The RAD/RAC & DAP/DAC system stays as it is currently.

The Basic Daily Care Fee remains as is currently: $50.16 per day (85% of single basic pension rate).

Means Tested Fee annual and lifetime caps remain in place: currently $26,964.71 and $64,715.36 respectively.

Changes:

Home Care packages up: An additional 14,000 packages (expected to be at Level 3 & Level 4) over the next 4 years.

RADs & RACs are still guaranteed if paid to an approved provider however there will be a levy imposed on all Aged Care Providers if defaults are greater than $3 million in a financial year.

The DHS’s Permanent Residential Aged Care Request for a Combined Assets and Income Assessment form (SA 457) is to be simplified and a new form in use by May 2019

Funds are being allocated to streamline the ACAS/ACAT assessment process and also towards improving the My Aged Care website.

There will be a trial of four programs involving information and community hubs aimed at improving consumer understanding of the aged care system.

The new Aged Care Quality & Safety Commission will commence from 1 January 2019 and will receive additional funding to enhance regulation of aged care.

Additional funding has been proposed to introduce 13,500 new residential care places and 775 short term restorative aged care services in 2018/19.

To encourage providers to build new aged care services, $60 million will be allocated towards capital investment for new places. Another $40 million will be allocated to providers in regional, rural and remote areas for construction and improvement, plus $105 million for aged care services in remote indigenous communities.

Additional funding will be allocated for palliative care services in residential care (subject to matched funding from the states and territories) as well as innovations in managing dementia and mental health programs for older Australians.

Victorian State Budget 2018

Speaking of budgets, last week’s Victorian State Budget had an interesting inclusion relating to future aged care workers.

From 1 January 2019 students will pay no tuition fees for 30 priority non-apprenticeship TAFE courses. Included in the list are several relevant to carers roles such as the Certificate IV in Ageing Support, Certificate IV in Disability and the Diploma of Nursing.

A good initiative I reckon!

Regards

Emmett

They deserve nothing less

They deserve nothing less

A move into residential aged care often involves major financial decisions being made under difficult circumstances. The support of an adviser who specializes in these matters and who can explain your options and their implications in an impartial and professional manner is desirable if not essential.

The ever-increasing life-expectancy we are enjoying brings with it the downside that many of us will experience debilitating illness in our later years. In particular the incidence of Dementia related illnesses has risen significantly and 80% of older Australians will access some form of community or residential aged care service[1].

The government has responded with financial support for residential aged care and a range of home-care support packages. Assisting a parent or relative or friend’s admission into residential care is often emotionally very challenging; navigating Centrelink, DVA & DHS regulations as well as having to choose a suitable facility can be extremely stressful.

A move into residential aged care often involves major financial decisions being made under difficult circumstances. The support of an adviser who specializes in these matters and who can explain your options and their implications in an impartial and professional manner is desirable if not essential.

When you first set foot in the Aged Care financial world you will find yourself confronted with a bewildering array of specialist terms each with its own 3-letter acronym. The fees associated with entering a facility are called a Refundable Accommodation Deposit (RAD) or Refundable Accommodation Contribution (RAC) which can be paid as a Daily Accommodation Payment (DAP) or Daily Accommodation Contribution (DAC).

The RAD is a lump sum payable to the facility for the right to occupy a room on their premises. It is important to understand that the resident will not own the room. The RAD which can range from $200,000 to over $1,000,000 will be repaid when the resident leaves the facility and is government guaranteed. Many factors influence the size of the RAD and all approved aged care facilities are required to list their RAD on the Commonwealth Government’s website – myagedcare.gov.au.

The entrant into care must deal with two financial issues: funding the RAD and ongoing cash-flow.

The RAD may be paid in full or in part with interest at a prescribed rate being payable on any outstanding balance. How to fund the RAD is one of the critical issues to be addressed by a specialist adviser. Options can include liquidating investments, borrowing, selling the family home or retaining it and renting it out. Each option has significant ramifications for other costs and government benefits.

Ongoing costs can include as many as five elements.

- If the RAD is not paid in full, there will be a continuing interest payment (DAP)

- All residents will pay a Basic Daily Fee which is set at 85% of the daily full rate age pension (currently $50.16). This rate applies irrespective of whether the resident actually receives an age pension.

- Some residents will be required to pay a Means Tested Fee (MTF) which is calculated under a formula taking into consideration both the resident’s assets and income. This fee can be as high as $245 per day.

- Fourthly some facilities charge what is called an Extra Services Fee. This allows access to a wider range of menu options, wine/beer with meals, cable TV and onsite facilities such as hairdressing. Not all facilities offer extra services but for some of those that do this is a mandatory fee.

- Finally, residents and their families may need to provide an additional sum for discretionary expenditure.

The total daily fees are tallied and the resident is billed monthly. Invoices of $1000 to $4000 are not unusual and reflect the chosen facility and the resident’s financial means. If a resident is in receipt of the Aged Pension or a Department of Veterans Affairs Pension then decisions made about how to fund the RAD and the ongoing daily fees can also affect the level of pension received.

Entering Residential Care is one of the biggest and most complex financial transactions most people will be involved in. Making the right choices will have a big impact on the family’s peace of mind and the resident’s comfort. They deserve nothing less.

Advisersure Financial Consultants is an Accredited Aged Care Professional practice specialising in aged care advice and is Corporate Authorised Representative No. 424041 of MyPlanner Professional Services Pty Ltd ABN 51 159 696 830 AFSL No. 425542

[1] Australian Institute of Health and Welfare: Australia’s welfare 2015

2018: A balancing act

Fidelity’s Investment Director, Tom Stevenson, shares his thoughts on investing in 2018.

Most of the time investors don’t need to think too much about market timing or asset allocation. The long-term trajectory of financial markets is up and the only sensible thing to do is to be fully invested and allow the odds to work in your favour. As we enter 2018, however, it doesn’t feel like ‘most of the time’. Nine years into the current equity bull market and with well-known and successful investors like Jeremy Grantham and Neil Woodford muttering darkly about investment ‘bubbles’, every investor’s New Year Resolution should be to look at their portfolio and understand the risks they are taking.

If you try to call the top of the equity market, one of three things will happen. You will get it just right, be too early or too late. The chance of the first is vanishingly small, so it is prudent to assume that if you try and time the market peak you will get it wrong. The only question that matters is how you want to be wrong. Do you care more about losing what you have accumulated in recent years or watching from the side-lines as others make profits that you have consciously foregone?

Whichever misjudgement you choose, it will probably be expensive especially if you are over-exposed to the equity market as most investors are. A year ago, you could have looked at the valuation of the US stock market and concluded that it was over-priced. Shares cost about 25pc more as a multiple of profits than their long-term average. If you had de-risked your equity portfolio at the beginning of 2017, you would have missed out on a 20pc rise in the S&P 500 and even more on the basis of the Dow Jones Industrials index or the Nasdaq.

Anyone bailing out of the market today risks a similar opportunity loss. In every market peak since the 1920s, returns have tended to accelerate in the six months before the market changes direction. On average, missing out on the final year of a bull market has meant leaving 20pc of gains on the table for someone else.

Being late is just as painful. Between 2000 and 2002, the same US benchmark index fell by nearly 50pc. Between the peak in 2007 and the bottom of the market in 2009, the fall was closer to 60pc. These are the exception not the rule but there are plenty of other examples of market falls of between 10pc and 20pc. Even these are worth avoiding if you can. Remember, a 50pc fall in the value of a portfolio requires a 100pc recovery simply to get back to square one.

So if like most people you feel the pain of a loss more than you enjoy the pleasure of a gain, you are probably thinking about protecting what you’ve got. How might you do that?

If you are really risk-averse, you may decide that the market has been driven by excessively loose central bank policy which is now reversing, that valuations have gone too far and that the market has had a fantastic run. You will swap all your investments for cash. Anyone doing this needs to understand that it comes with a significant cost. It’s not just the opportunity cost, it’s the fact that assets like cash with the lowest risks also guarantee the lowest returns. All the while that you are ‘de-risked’ you will be losing money in real terms.

The good news is that you don’t need to do this. If you are prepared to accept that a portion of your portfolio will indeed go ‘over the cliff’ when the market inevitably turns you can still minimise your losses and maintain some exposure to any final ‘melt-up’ phase in the market by injecting some balance into your investments.

To see how this worked the last time an equity market bubble burst, let’s jump back in time to the 1999-2003 boom and bust. In 1999, emerging market equities delivered a total return of 72pc while Japanese shares returned 67pc. A well-diversified global equity fund would have given you 31pc while the defensive assets in your balanced portfolio would have looked drearily pedestrian at 6pc for cash, 3pc for corporate bonds and a modest fall in the value of any government bonds you held.

The following year as the equity bubble burst, the emerging market equities that topped the table in 1999 were the worst performers, losing more than 25pc of their value and the Japanese shares were not far behind. Offsetting those falls, however, were cash, with a slightly higher return than the previous year and double digit returns from all types of debt: emerging market, corporate and government. In 2001, it was the same story. By 2003, however, the tables had turned with emerging market equities the top performer and government bonds at the bottom of the list.

One of the problems with how we think about our investments is that we are encouraged by the media to think it is all about equities. This is natural. Shares are more newsworthy because they bounce around more than bonds and are more closely linked to the ups and downs of corporate news. But this focus on shares encourages us to think in black and white terms about the market. If your New Year’s Resolution is to take some risk off the table, don’t overdo it and don’t swap one unbalanced portfolio full of equities for another stuffed full of cash. At this uncertain point in the cycle you can’t be too diversified.

Source:

Written by Tom Stevenson, Investment Director, Fidelity Australia.

Reproduced with permission of Fidelity Australia. This article was originally published at https://www.fidelity.com.au

This document has been prepared without taking into account your objectives, financial situation or needs. You should consider these matters before acting on the information. You should also consider the relevant Product Disclosure Statements (“PDS”) for any Fidelity Australia product mentioned in this document before making any decision about whether to acquire the product. The PDS can be obtained by contacting Fidelity Australia on 1800 119 270 or by downloading it from our website at www.fidelity.com.au. This document may include general commentary on market activity, sector trends or other broad-based economic or political conditions that should not be taken as investment advice. Information stated herein about specific securities is subject to change. Any reference to specific securities should not be taken as a recommendation to buy, sell or hold these securities. While the information contained in this document has been prepared with reasonable care, no responsibility or liability is accepted for any errors or omissions or misstatements however caused. This document is intended as general information only. The document may not be reproduced or transmitted without prior written permission of Fidelity Australia. The issuer of Fidelity Australia’s managed investment schemes is FIL Responsible Entity (Australia) Limited ABN 33 148 059 009. Reference to ($) are in Australian dollars unless stated otherwise.

© 2018. FIL Responsible Entity (Australia) Limited.

Important:

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for any action or any service provided by the author.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

Beyond share prices

Investors shouldn’t overlook that there are two components to sharemarket returns – dividend yield and capital gains (or losses).

Few investors would have missed the news reports of late pointing out that although Australia’s sharemarket has broken through the 6000-point mark, it’s still below the record pre-GFC high.

But looking at share price movements alone can give investors a misleading impression and encourage them to overreact to short-term market shifts and other market “noise”.

And by excessively focussing on asset price movements, investors may overlook the rewards from compounding total returns (as returns are earned on past returns) and from taking a strategic, long-term approach to investing.

Once reinvested dividends are taken into account, the performance of the Australian sharemarket in the GFC aftermath looks much better – particularly considering the benefits of dividend franking.

On 1 November, 2007, the S&P/ASX200 (prices only) closed at 6828.7 points, its pre-GFC closing high. And on 6 March, 2009, this index closed at 3145.5, its lowest close in the depths of the GFC.

By contrast on 1 November, 2007, the S&P/ASX200 accumulation index (share price plus reinvested dividends) closed at 43,094.3, its pre-GFC high. And on 6 March, 2009, this index fell to 21,298.1, its lowest point in the depths of the GFC.

Now move forward to the beginning of 2018.

On 2 January, 2018, the S&P/ASX200 Index (prices only) opened at 6065.1 points. This was still below its pre-GFC closing high yet 93 per cent above its GFC closing low.

And on the same day, (2 January, 2018), the S&P/ASX200 accumulation index opened at 60,387.4. This was 40 per cent above its pre-GFC closing high and 184 per cent above its GFC closing low.

Figures from super fund researcher SuperRatings reinforce why investors should take a disciplined, long-term approach without being swayed by day-to-day movements in asset prices.

SuperRatings estimates that $100,000 invested in a median balanced super fund on November 1, 2007 – remember that is the day when the Australian market reached its pre-GFC closing high – would have increased to $163,218 by the beginning of 2018. Critically, the total doesn’t include contributions.

Source:

Written by Robin Bowerman, Head of Market Strategy and Communications at Vanguard.

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2018 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for any action or any service provided by the author.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

Power of retiree super dollars

With the waves of baby boomers now nearing or entering retirement, it is hardly surprising that the ranks of retired super members is rapidly growing. Yet the extent of that growth may surprise you.

The latest Superannuation Market Projections report, recently published by independent consultants Rice Warner, forecasts that the number of members with retirement accounts will rise by almost 70 per cent over the next 15 years to more than 3.7 million.

And the total value of retirement assets in super is expected to grow from $828.9 billion (as at June 2017) to $1.335 trillion in 2017 dollars over the same period.

However, the retirement segment of superannuation is not a story of straight-out growth. There are interesting dynamics occurring.

Rice Warner projects that retirement segment’s share of total superannuation assets will reduce from 35.6 per cent today to 31 per cent over the next 15 years.

This expected dip in market share is largely due the combination of retirees drawing down on their savings, and the growth in assets and members in the accumulation phase.

An even higher proportion of retirees in future are likely to take their super benefits as a pension rather than a lump sum – further breaking down the myth that Australia is a lump-sum society in regards to super.

“With the [superannuation] industry’s focus on member education, improved financial literacy of the general population, and retirement products aimed at helping members preserve retirement assets, we expect a decrease in the rate of lump sum benefits at retirement,” Rice Warner comments.

Over the next 15 years, the proportion of members taking their super as pensions rather than lump sums is expected to reach 90 per cent, “resulting in a positive cash flow in the long term” for super’s retirement sector.

It is anticipated that the biggest change will occur in the market share of the retirement dollars held by the different superannuation fund sectors.

Rice Warner forecasts that the market share of retirement assets held by the various fund sectors to significantly change over the next 15 years to: SMSFs, 44 per cent (58 per cent today); industry funds, 18.9 per cent (7.6 per cent today); commercial retirement products, 29.4 per cent (26.1 per cent today); public-sector funds, 7.8 per cent (7 per cent today); and corporate funds, nil per cent (1.3 per cent today).

The expected reduction in the proportion of retirement superannuation dollars held in self-managed super is readily understandable given that SMSFs hold by far the biggest market share of retiree super savings. SMSFs will therefore experience the largest proportion of retirement drawdowns.

Source:

Written by Robin Bowerman, Head of Market Strategy and Communications at Vanguard.

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2018 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for any action or any service provided by the author.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

Superannuation and moving overseas

If you’re an Australian permanent resident or citizen heading overseas, your super remains subject to the same rules, even if you are leaving Australia permanently. This means your super must remain in your super fund/s until you reach preservation age and are eligible to access it.

Can I contribute while I’m away?

Probably. However, there are restrictions on contributions to self-managed super funds (SMSFs).

People in other super funds often continue to make personal contributions to their Australian super fund while away to ensure their balance continues to grow and to cover any insurance premiums being deducted. In circumstances where you are working for an Australian employer internationally (see below) they may also be required to continue making Superannuation Guarantee payments into your account.

If you’re planning on heading overseas for an extended period of time it’s a good idea to do some research into funds which can offer a suitable choice of investments for your needs without charging excessive fees, while you’re away. This will help your balance grow even if you are no longer contributing.

Working overseas for an Australian employer

If your Australian employer sends you to work in another country, usually they will still be required to make Superannuation Guarantee payments into your super account. Australia has bilateral social security agreements with a number of countries that remove the issue of double superannuation coverage that might occur if you or your employer are required to make superannuation (or equivalent) contributions under the legislation of both countries for the same work. Visit the ATO website or call 13 10 20 for more information.

Temporary residents

If you are an overseas resident working temporarily in Australia, you may be eligible to be paid your superannuation money once you have left Australia through what is known as a departing Australia superannuation payment (DASP). For more information or to apply, visit the ATO website.

Source:

Reproduced with the permission of the The Association of Superannuation Funds of Australia Limited. This article was originally published at http://www.superguru.com.au/manage-your-super/moving-overseas

Important:

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person. Past performance is not a reliable guide to future returns.

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for any action or any service provided by the author.